Card Brand Updates: October 2022

Effective October 14, 2022, we will update our systems to reflect the October card brand technical changes. Here's an overview of what's happening.

Visa

-

Visa will introduce two new charge types that will impact merchants who process Visa transactions that are not settled in their domestic currency. The charge types do not apply to Visa Direct credit transactions.

- Visa non-domestic settlement fee

- Visa multi-currency non-domestic settlement fee

-

Visa added 13 additional MCCs:

- 3630 Lodging--Tokyu Hotel

- 3756 Lodging--Toyoko Inn

- 7322--Debt Collection Agency

- 8082--Healthcare

- 3019--Eastern Airline

- 3070--Fly Dubai

- 3080--Airline Scoop Inc

- 3081--Xiamen Airlines

- 3303--Tigerair

- 3308--China Southern

- 3780--Disney Resorts

- 5662--Tier 1 Supermarket-MDS

- 5663--Tier 2 Supermarket-MDS

-

Visa will introduce the new Visa Flexible Credential prepaid consumer product. The interchange fee programs will apply to transactions completed with the new Visa Flexible Credential prepaid product.

-

Effective November 1, 2022, Visa will implement new Consumer Bill Payment Service rates. These rates will match current rates for existing Emerging Market categories.

-

Receipt Requirements - In October 2020, Visa amended its rules to prohibit printing of the full merchant identification numbers (MIDs), terminal identification numbers (TIDs) and card acceptor identification numbers (CAIDs) on cardholder receipts. Printing of all MIDs, TIDs and CAIDs must be limited to the last four digits. Due to the effort required to comply with this mandate, Visa has issued amended dates for this requirement. The amended effective dates are as follows:

- On October 15, 2022, the amendment will apply to newly deployed devices. Please note, this date does not apply to devices currently in use in the field.

- On October 15, 2027, the amendment will apply to all devices deployed and in use in the market.

Mastercard

-

Mastercard is lowering thresholds in October, then increasing the fee annually through January 2025. Both US and Canadian settled transactions are impacted.

-

Masterard is limiting the issuer authorization related chargebacks to the amount of the gratuity with an authorization tolerance of 30%. Final autorized transactions are not subject to gratuity tolerance.

-

Mastercard will allow refund/return transactions for healthcare programs to be submitted online to the issuer for approval in the US region.

-

Mastercard will be removing an internal filer that prevented most ASI transactions from being processed by the Stand-In Authorization Service.

- The service help customers manage risk and maintain business continuity when card issuers are down or unavilable.

- This service utilizes response code 85: Not declined to approve ASI authorization.

- A Stand-In Authorizations does not support CVC 2 validation or address verification.

-

Mastercard will increase the Excessive Authorization Attempts Fee and reduce the threshold of declined issuer attempts from 20 to 10 to incur this fee. This fee will apply to all merchants who submit excessive authorization attempts that are declined by the issuer based on the following criteria.

- After 10 issuer declined authorizations on the same card, using the same card acceptor ID (merchant account) within a 24-hour period.

- Effective November 7, 2022, the fee will apply and increase over time by January 2025.

Discover

- Discover is updating the product and fee codes associated to the consumer interchange programs for Credit, Debit, and Prepaid card products for Charity and Public Services programs.

American Express

-

Amex will be introducing 2 new Processing Codes to support Authorizations on Credit transactions. Merchants will still need to submit the credit even if they don't obtain prior authorization.

- 200000--Credit/Return Authorization

- 200800--Credit/Return Authorization with Address Verification

-

Amex is introducing new program pricing for Charity, Insurance, Online Gambling, Residential Rent, Emergin Market and Utilities categories.

-

Revised existing Program pricing for Education and Government categories.

-

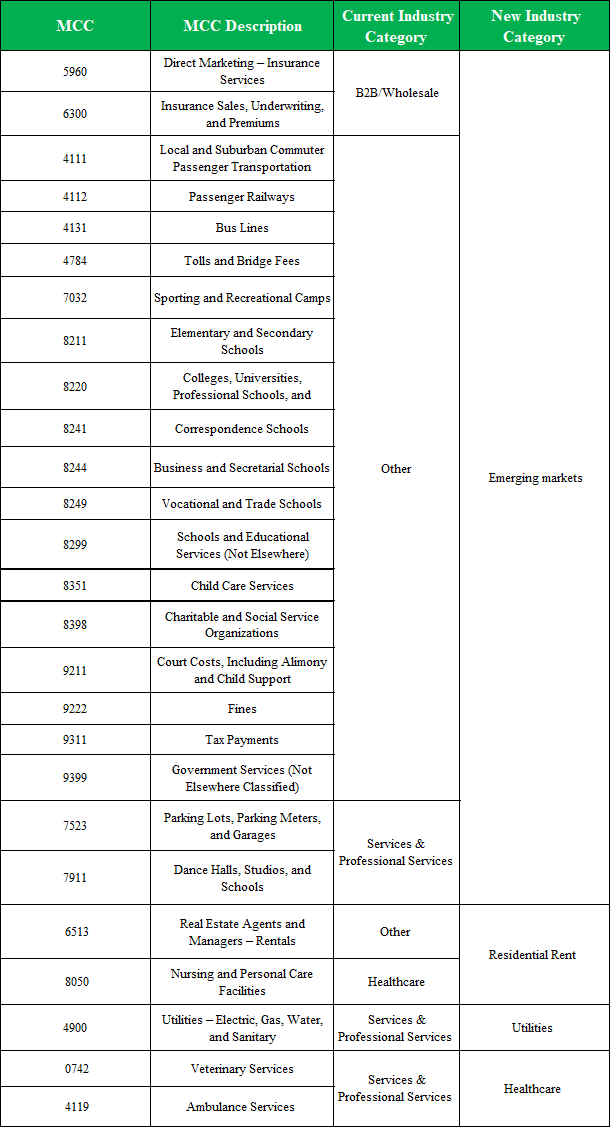

Revised existing MCC mappings Industry SE categories to reflect MCC mapping for Charity, Education, Emerging Markets, Government, Insurance, Online Gambling, Other, Residential Rent, Services & Professional Services, and Utilities categories.

-

Amex is also introducing a new wholesale discount rate programs as well as revise the merchant category codes (MCCs) that fall into the applicable industry categories. In addition, Amex will update the rate structure and remove the current volume tiers for the OptBlue healthcare program.

Below are the revised MCCs by Industry Category:

3D Secure Update

- Retirement of 3-D Secure protocol 1.0.X will be decommissioned or subset effective Octover 15th, 2022, including all related technology for Discover Protect Buy, Visa 3D Secure, MasterCard 3DS and Amex Safekey.