Analyzing the drawer checkout report

The Drawer Checkout report contains three primary sections: the Header section, the Drawer Balance section, and the Sales section (optional).

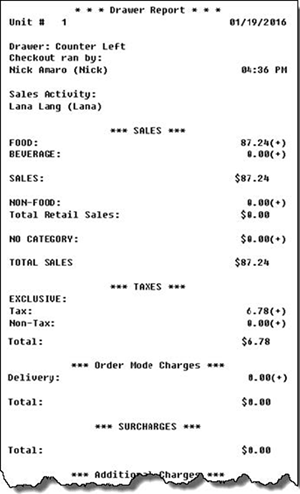

If there are no cashier transactions for an entire transaction type, the transaction type does not appear on the report. For example, if no surcharges were assessed, the 'Surcharges' transaction type does not appear, regardless of the BOH configuration.

The report uses algebraic expressions to visually represent areas that are subtracted or added to achieve the drawer totals.

- (+) indicates the transaction type is added to the 'Cash in Drawer' total.

- (-) indicates the transaction type is subtracted from the 'Cash in Drawer' total.

- (=) indicates the final result of the calculation.

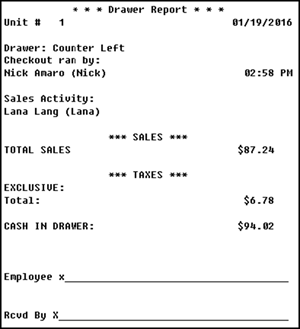

Header information section

The Header Information section appears at the top of the report and contains the date, time, drawer number, the employee who ran the report, the employees who had sales activity for the drawer, and more.

The Header Information section displays the following columns and rows:

| Row Heading | Description/calculation |

|---|---|

| title | Title of the report. If you elected to reset the drawer totals, the title appears as 'Drawer Checkout.' If you elected not to reset the drawer totals, the title appears as 'Drawer Report.' |

| Unit # | The unit number of the store, as defined in Maintenance > Business > Store > Location Information. |

| report date | Date you ran the report. |

| Drawer: | The name of the drawer for which you ran the report. |

| time | Time you ran the report. |

| Checkout ran by: | Name of the employee who ran the report. |

| Sales Activity | List of all employees who applied a payment and closed a check with this cash drawer. |

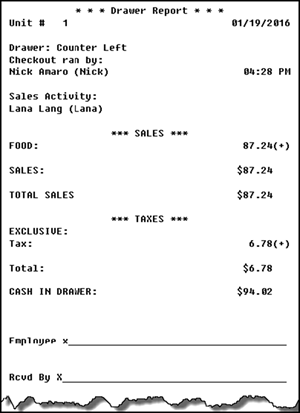

Drawer balance information section

The Drawer Balance section appears after the Header Information section and contains the information you use to calculate the expected amount of cash in the drawer. If you have more than the expected amount, you are 'over.' If you have less than the expected amount, you are 'short.'

The Drawer Balance section displays the following columns and rows:

| Row Heading | Description/Calculation |

|---|---|

| SALES (+) | Total adjusted sales of all items with 'Revenue Item' selected in Maintenance > Menu > Items > General Settings tab > General group bar. |

| > name of sales category | Adjusted sales total from each sales and retail category, based on the following calculation: straight sales - comps - promos - voids. A line item for each category prints on the report, if you select 'List All' or 'List All with Values' and the transaction type had activity. |

| TAXES: (+) | Total exclusive and inclusive taxes applied to sales. |

| > name of tax ID | Total from each exclusive and inclusive tax ID applied to sales. A line item for each tax prints on the report, if you select 'List All' or 'List All with Values' and the transaction type had activity. |

| GST: (+) | Total goods and services taxes applied to sales. |

| ORDERMODE CHARGES:(+) | Total order mode charges applied to guest checks sent to an order mode defined with a service charge in Maintenance > System Settings > Order Mode. |

| > name of order mode charge (+) | Total from each order mode charge applied to qualifying guest checks. See prior definition. A line item for each order mode prints on the report, if you select 'List All' or 'List All with Values' and the transaction type had activity. |

| SURCHARGES: (+) | Total surcharges assessed on all items defined with a surcharge in Maintenance > Taxes > Surcharge. |

| > name of surcharge (+) | Total from each qualifying surcharge. See prior definition. A line item for each surcharge prints on the report, if you select 'List All' or 'List All with Values' and the transaction type had activity. |

| ADDITIONAL CHARGES: (+) | Total additional charges applied to guest checks, as defined in Maintenance > Business > Store > Store Settings tab> Financials group > Additional charges group bar. |

| GC SOLD: (+) | Total adjusted sales of all items with 'Gift Card' and 'Activate Card', or 'Gift Cert' selected in Maintenance > Business > Store > Store Settings tab > Gift Card/Certificate Sales group. |

| > name of gift card or gift certificate sold (+) | Total adjusted sales from each qualifying gift card item. See prior definition. A line item for each gift card or gift certificate prints on the report, if you select 'List All' or 'List All with Values' and the transaction type had activity. |

| CASH CARD SOLD: (+) | Total adjusted sales of all items with 'Cash Card' selected in Maintenance > Payments > Tenders > Tender tab. |

| > name of cash card (+) | Total adjusted sales from each qualifying 'Cash Card' item. See prior definition. A line item for each cash card prints on the report, if you select 'List All' or ‘List All with Values' and the transaction type had activity. |

| REV ITEMS SOLD: (+) | Total adjusted sales of all items with ‘Revenue Item’ selected in Maintenance > Menu > Items > General Settings tab > General group bar. > name of revenue item. |

| name of revenue item: (+) | Total adjusted sales from each qualified 'Revenue Item.' See prior definition. A line item for each revenue item prints on the report, if you select 'List All' or 'List All with Values' and the transaction type had activity. |

| NON CASH PAYMENTS: (-) | Total amount of all non cash payments, without a tip, applied to guest checks. |

| > name of non-cash payment (-) | Total amount from each non-cash payment type, without a tip, applied to guest checks. A line item for each type of non-cash payment prints on the report, if you select 'List All' or 'List All with Values' and the transaction type had activity. |

| NON CASH TIPS: (+) | Total amount from all non cash tips. |

| > name of non cash tip (+) | Total amount from each non-cash tip. A line item for each type of non-cash tip prints on the report, if you select 'List All' or 'List All with Values' and the transaction type had activity. |

| CASH TIPS: (+) | Total amount of all cash tips, including cash auto gratuities. |

| CASH TXNS: (+/-) | Total amount of all paid ins and paid outs, excluding cash transactions done using the Tip Out function. |

| > name of pretty account (+) | Total amount from each petty cash account. A line item for each petty cash account prints on the report, if you select 'List All' or 'List All with Values' and the transaction type had activity. |

| TIP OUTS: (-) | Total amount of tips distributed to other employees. |

| N/R PAYMENTS (+) | Total amount of non-redeemed payments applied to sales. For example, if you received a $10.00 gift certificate for which you cannot give change back to the customer, for a $9.50 check, $0.50 appears in the total. |

| > name of tender (+) | Total amount from each tender applied to sales in which a non-redeemed payment occurred. A line item for each type of non-redeemed tender prints on the report, if you select 'List All' or 'List All with Values' and the transaction type had activity. |

| ROUNDING BENEFIT (+/-) | Difference between the actual total amount in the drawer against any rounding in effect, as defined in Maintenance > Payments > Tenders > Rounding tab. If the benefit is to the advantage of the store, then (+) displays, otherwise, (-) displays. |

| CASH IN DRAWER: (=) | Expected amount in the cash drawer for reconciliation. Use this amount to balance the cash drawer. |

| Employee X_ | Signature line for the employee assigned to the drawer when you ran the report. |

| Rcvd By X_ | Signature line for the employee accepting the cash. |

Sales section

The Sales section is an optional section that contains reference information used to match against the BOH totals. In some environments, such as server banking, the drawer totals in the Sales section will not be the same as the totals in the Drawer Balance section.

The Sales section displays the following columns and rows:

| Row Heading | Description/Calculation |

|---|---|

| GROSS SALES: (+) | Total sales generated by the cash drawer, excluding voids and revenue items. |

| TAXES: (-) | Total amount of all exclusive, inclusive, and GST taxes applied to sales. |

| > name of tax ID (-) | Total from each exclusive and inclusive tax ID applied to sales. A line item for each tax prints on the report, if you select 'List All' or 'List All with Values' and the transaction type had activity |

| COMPS: (-) | Total amount of comps applied to sales. If you select 'Include Comps in Net Sales' in Maintenance > Business > Store > Store Settings tab > Financials group > Reports tab, then no algebraic symbol displays. |

| > name of comp (-) | Total from each comp applied to sales. A line item for each comp prints on the report, if you select 'List All' or 'List All with Values' and the transaction type had activity. |

| PROMOS: (-) | Total amount of promos applied to sales. If you select 'Include Promos discounts in Net Sales' in Maintenance > Business > Store > Store Settings tab > Financials group > Reports group bar, then no algebraic symbol displays. |

| > name of promo (-) | Total from each promo applied to sales. A line item for each promo prints on the report, if you select 'List All' or 'List All with Values' and the transaction type had activity. |

| ORDER MODE CHARGES: (-) | Total order mode charges applied to guest checks sent to an order mode defined with a service charge in Maintenance > System Settings > Order Mode. |

| > name of order mode charge: (-) | Total from each qualifying order mode charge applied to guest checks. See prior definition. A line item for each order mode prints on the report, if you select 'List All' or 'List All with Values' and the transaction type had activity. |

| SURCHARGES: (-) | Total surcharges assessed on all items defined with a surcharge in Maintenance > Taxes > Surcharge. |

| > name of surcharge: (-) | Total from each qualifying surcharge assessed on all items. See prior definition. A line item for each surcharge prints on the report, if you select 'List All' or 'List All with Values' and the transaction type had activity. |

| NET SALES: (=) | Result of the Sales section, based on the following calculation: gross sales - taxes - comps - promos - order mode charges - surcharges. |

Caution: Do not use the Sales section totals to balance the cash drawer.

Continue to "Reporting Drawer Checkout."