Associating Sweetened Beverage Tax tax group to an item

You must associate the appropriate tax group to the corresponding beverage item. The makeup of beverages in your database could vary. Typically, a separate item is created based on size, which is ideal for this solution. For example, if you sell a beverage by small, medium, and large, a separate item is created for each and you can easily associate the correct tax group to the appropriate size of beverage. Similarly, if you sell canned and bottled beverages, each item is sold by size.

If you have a single beverage item that represents all sizes, consider breaking up the beverage items in your database, by size. You should also consider diet and ‘sugar-free’ beverages you sell, and tax them appropriately.

To associate the Sweetened Beverage Tax tax group to an item:

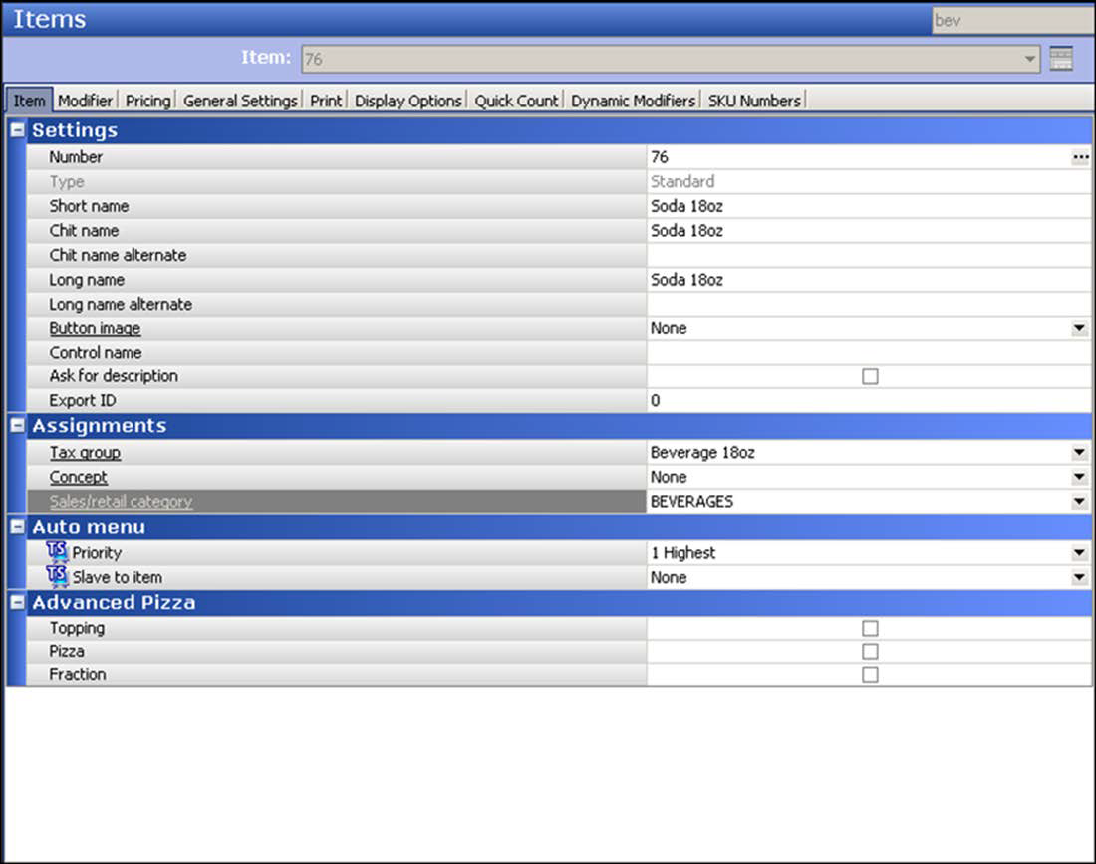

- Select Maintenance > Menu > Items.

- Select a beverage item from the list.

- Under the ‘Assignments’ group bar, select the appropriate tax group from the ‘Tax group’ drop-down list. For example, if your small beverage is 18 ounces, select the tax group you created for the 18 oz sweetened beverage tax.

- Click Save.

- Repeat this procedure for other items that require the sweetened beverage tax group.

- Exit the Items function.

Continue to "Enabling surcharges at the site level."