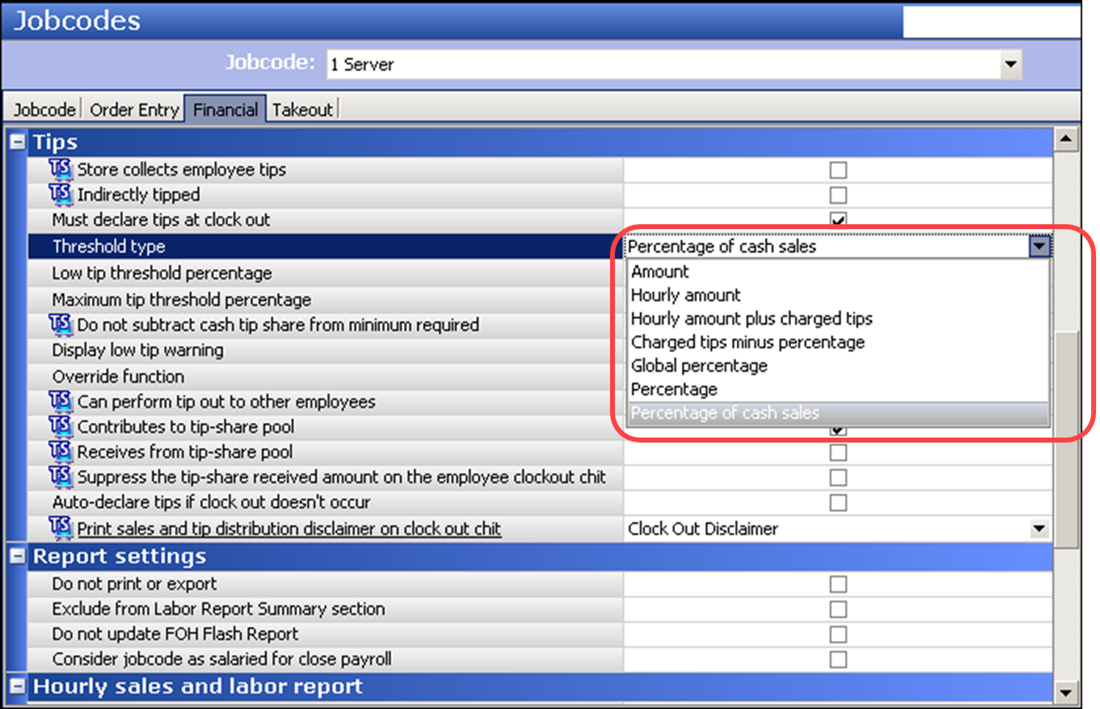

Choosing the tip declaration threshold type

The job code under which an employee logs in determines the threshold type, if any, the employee uses for declaring their tips. For example, an employee who clocks in as a server can have different requirements for declaring tips than an employee who clocks in as a busser. You can choose from several threshold types for declaring tips based on the requirements of the job performed by the employee.

Note: The calculations in each of the threshold types might include a tip-share distribution value. Tip share is available in Table Service only.

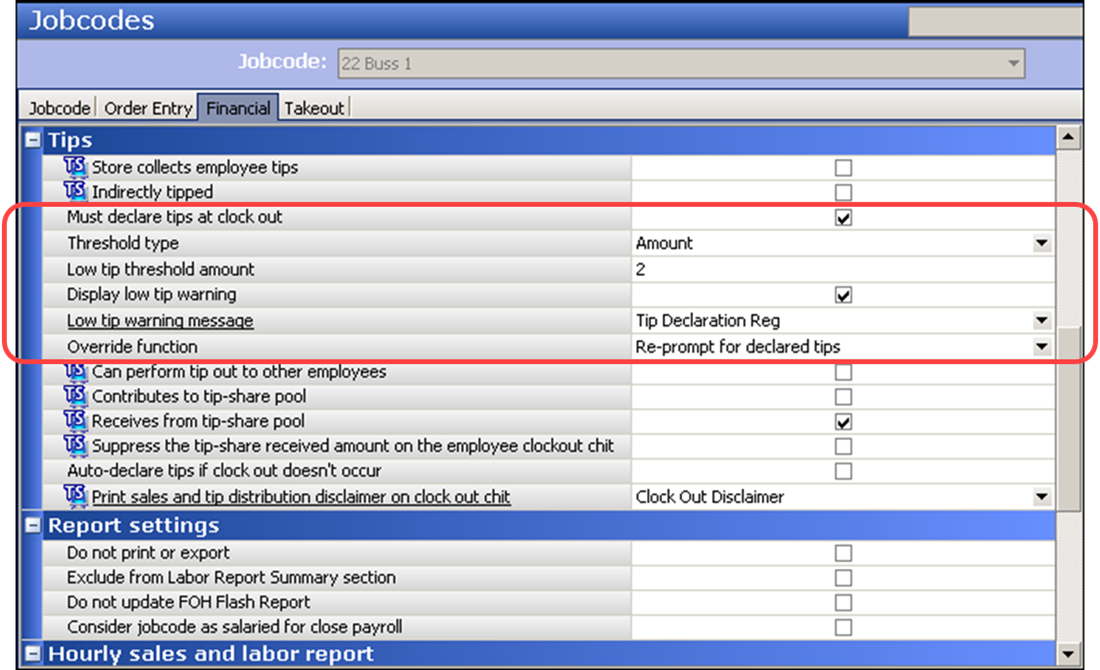

Amount

The ‘Amount’ threshold type uses a fixed dollar amount as the low tip declaration threshold and is based on the following calculation:

-

the greater of ‘Low tip threshold amount’ established for the job code (fixed amount).

-OR-

-

the charged tips for the employee (when you clear ‘Allow tip declaration less than charged tips’).

Use this threshold type for non-order entry employees who receive and must declare tips, such as bussers and dishwashers.

SCENARIO: The bussers at a restaurant receive approximately $2.00 in indirect tips from the wait staff. To ensure they declare their tips, type ‘2’ in ‘Low tip threshold amount.’ When the busser clocks out of the system, they must declare a minimum of $2.00 in tips.

To configure a job code to use the ‘Amount’ tip declaration threshold type:

-

Select Maintenance > Labor > Jobcodes > Financial tab.

-

Select a job code from the ‘Number’ drop-down list and press Enter.

-

Under the ‘Tips’ group bar, select Must declare tips at clock out.

-

Select Amount from the ‘Threshold type’ drop-down list.

-

Type the minimum amount an employee must declare in ‘Low tip threshold amount.’ For example, ‘2.’

-

Select Display low tip warning. If you clear this option, a message does not appear when an employee declares an amount outside the tip declaration threshold. You must select ‘Shift required to clock in/out’ on the Jobcode tab and ‘Must declare tips at clock out’ on the Financial tab to enable this option.

-

Select the appropriate low tip warning message from the drop-down list. You can choose to display the default message, a custom message, or no message at all.

-

Select the override function for the system to take when an employee receives a message after declaring a tip amount outside of the declaration threshold. You can let the employee continue with their clock out, display another prompt for the employee to declare their tips again, or require manager approval for the employee to clock out.

Note: To allow an employee, typically a manager, to approve a clock out, select ‘Approve clock out’ in Maintenance > Labor > Pos Access Levels > Employee group bar for the access level to which the employee is assigned. If the employee declaring their tips is allowed to approve clock outs, the system assumes they are approving their own clock out and does not display the manager approval screen. The employee clocks out with the declared tips they entered.'

-

Click Save.

-

Continue configuring each job code for tip declaration or exit the Jobcodes function.

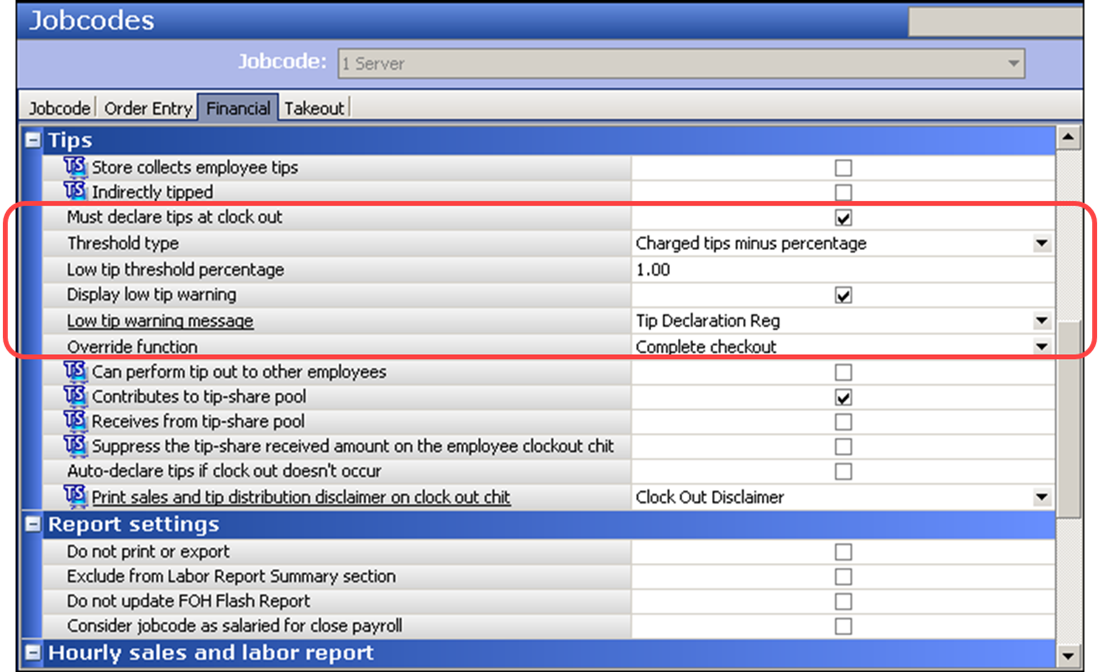

Charged tips minus percentage

Use the ‘Charged tips minus percentage’ threshold type if the tip declaration for your operations is based on the following calculation:

Charged tips for the employee - tip refunds - tip share contribution - (low tip threshold percentage for job code x employee tippable sales)

If the result is less than zero, the system rounds up and uses the value of zero.

SCENARIO: A server enters $215.00 in tippable sales, receives $13.00 in charged tips, and pays out $3.00 in tip share. The restaurant sets the ‘Low tip threshold percentage’ to ‘1.’ When the server clocks out of the system, they must declare a minimum of $7.85 in tips. ($13.00 - $3.00) - (1% x $215.00) = $7.85.

To configure a job code to use the ‘Charged tips minus percentage’ tip declaration threshold type:

-

Select Maintenance > Labor > Jobcodes > Financial tab.

-

Select a job code from the ‘Number’ drop-down list and press Enter.

-

Under the ‘Tips’ group bar, select Must declare tips at clock out.

-

Select Charged tips minus percentage from the ‘Threshold type’ drop-down list.

-

Type the percentage of tippable sales to subtract from their charged tips in ‘Low tip threshold percentage. For example, ‘1.00.’

-

Select Display low tip warning. If you clear this option, a message does not appear when an employee declares an amount outside the tip declaration threshold. You must select ‘Shift required to clock in/out on the Jobcode tab and ‘Must declare tips at clock out’ on the Financial tab to enable this option.

-

Select the appropriate low tip warning message from the drop-down list. You can choose to display the default message, a custom message, or no message at all.

-

Select the override function for the system to take when an employee receives a message after declaring a tip amount outside of the defined declaration threshold. You can let the employee continue with their clock out, display another prompt for the employee to declare their tips again, or require manager approval for the employee to clock out.

Note: To allow an employee, typically a manager, to approve a clock out, select ‘Approve clock out’ in Maintenance > Labor > Pos Access Levels > Employee group bar for the access level to which the employee is assigned. If the employee declaring their tips is allowed to approve clock outs, the system assumes they are approving their own clock out and does not display the manager approval screen. The employee clocks out with the declared tips they entered.

-

Click Save.

-

Continue configuring each job code for tip declaration or exit the Jobcodes function.

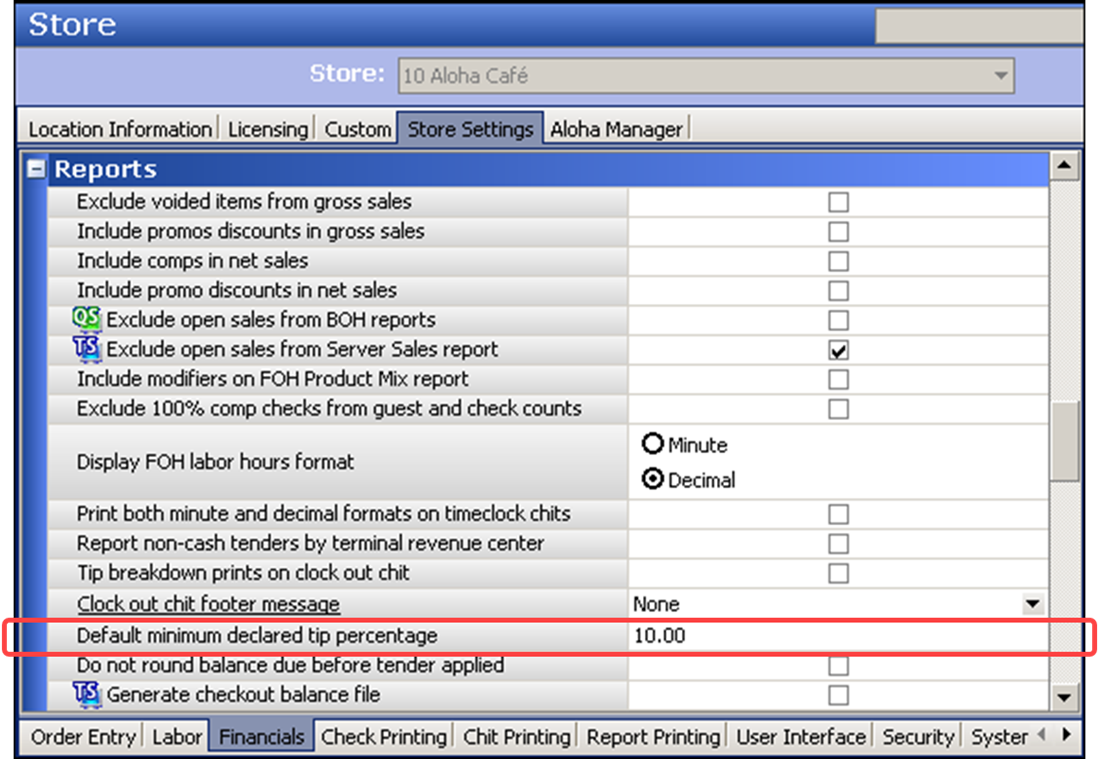

Global percentage

The ‘Global percentage’ threshold type specifies the tip threshold percentage, by store, based on the following calculation:

-

Default minimum declared tip percentage’ x tippable sales for the employee.

-OR-

-

charged tips for the employee (when you clear ‘Allow tip declaration less than charged tips).

You must type a percentage in ‘Default minimum declared tip percentage’ in Maintenance > Business > Store > Store Settings > Financial group > Reports group bar.

Note: All job codes configured with the ‘Global percentage’ threshold type use the same percentage. You cannot have more than one global percentage threshold.

SCENARIO: A server enters $100.00 in tippable sales. The restaurant sets the ‘Default minimum declared tip percentage’ for the store to ‘10.’ When the server clocks out of the system, they must declare a minimum of $10.00 in tips. ($100.00 x 10% = $10.00).**

To establish the global percentage to use for the tip declaration threshold:

- Select Maintenance > Business > Store > Store Settings tab.

- Select the Financials group located at the bottom of the screen.

- Under the ‘Reports’ group bar, type the default minimum tip percentage of tippable sales an employee must declare in ‘Default minimum declared tip percentage.’ For example, 10.00.

- Click Save and exit the Store function.

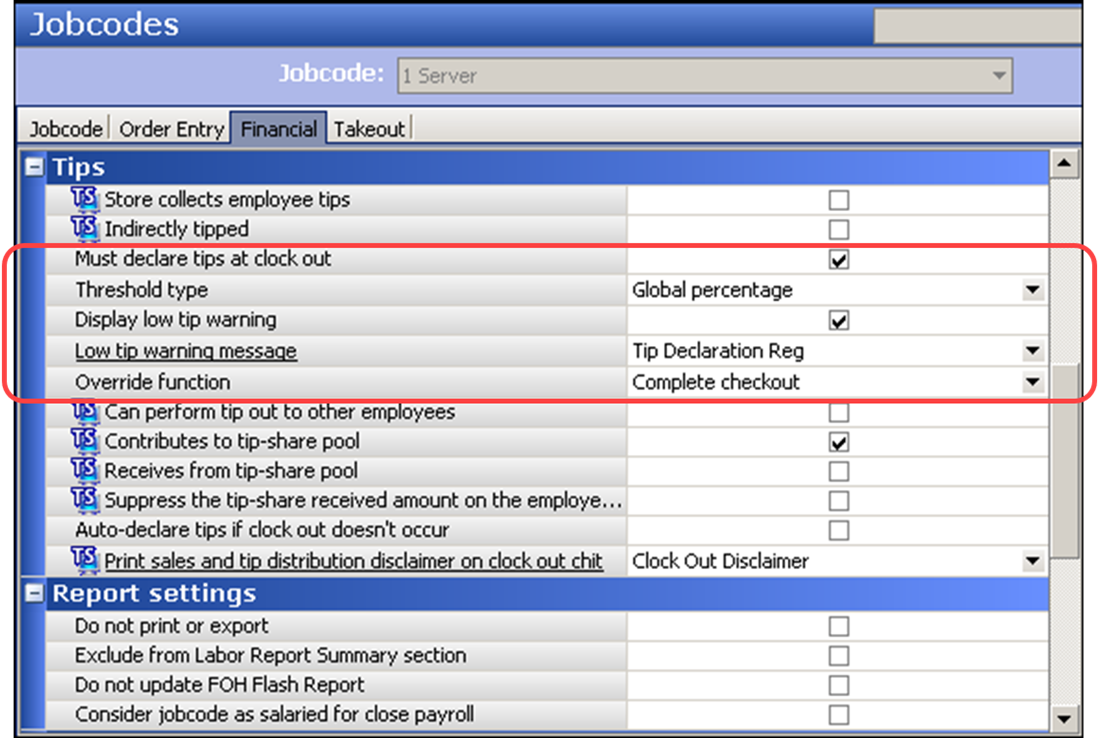

To configure a job code to use the ‘Global percentage’ tip declaration threshold type:

-

Select Maintenance > Labor > Jobcodes > Financial tab.

-

Select a job code from the ‘Number’ drop-down list and press Enter.

-

Under the ‘Tips’ group bar, select Must declare tips at clock out.

-

Select Global percentage from the ‘Threshold type’ drop-down list.

-

Select Display low tip warning. If you clear this option, a message does not appear when an employee declares an amount outside the tip declaration threshold. You must select ‘Shift required to clock in/out’ on the Jobcode tab and ‘Must declare tips at clock out’ on the Financial tab to enable this option.

-

Select the appropriate low tip warning message from the drop-down list. You can choose to display the default message, a custom message, or no message at all.

-

Select the override function for the system to take when an employee receives a message after declaring a tip amount outside of the defined declaration threshold. You can let the employee continue with their clock out, display another prompt for the employee to declare their tips again, or require manager approval for the employee to clock out.

Note: To allow an employee, typically a manager, to approve a clock out, select ‘Approve clock out’ in Maintenance > Labor > Pos Access Levels > Employee group bar for the access level to which the employee is assigned. If the employee declaring their tips is allowed to approve clock outs, the system assumes they are approving their own clock out and does not display the manager approval screen. The employee clocks out with the declared tips they entered.

-

Click Save.

-

Continue configuring each job code for tip declaration or exit the Jobcodes function.

Hourly amount

Use the ‘Hourly amount’ threshold type if you want your tip declaration threshold based on the following calculation:

-

the ‘Low tip threshold amount’ for the job code x number of hours employee works

-OR-

-

charged tips for the employee (when you clear Allow tip declaration less than charged tips).

The system uses the current system date and time as the ending work time, since the employee has not actually clocked out.

SCENARIO: A server works three hours and receives $10.00 in charged tips. The restaurant sets the ‘Low tip threshold amount’ to ‘5.’ When the server clocks out of the system, they must declare at least $15.00. (3 hours x 5 = 15, which is greater than the $10.00 in charged tips).

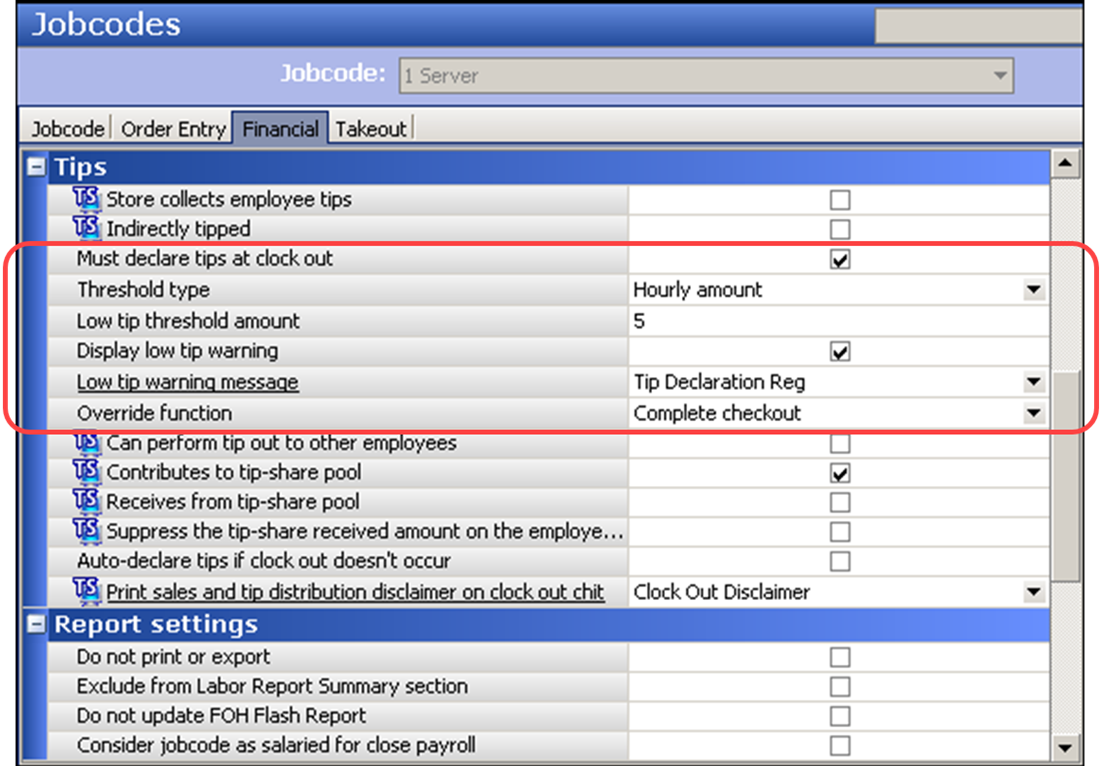

To configure a job code to use the ‘Hourly amount’ tip declaration threshold type:

-

Select Maintenance > Labor > Jobcodes > Financial tab.

-

Select a job code from the ‘Number’ drop-down list and press Enter.

-

Under the ‘Tips’ group bar, select Must declare tips at clock out.

-

Select Hourly amount from the ‘Threshold type’ drop-down list.

-

Type the minimum amount, per hour worked, an employee must declare in ‘Low tip threshold amount.’ For example, ‘5.’

-

Select Display low tip warning. If you clear this option, a message does not appear when an employee declares an amount outside the tip declaration threshold. You must select Shift required to clock in/out on the Jobcode tab and Must declare tips at clock out on the Financial tab to enable this option.

-

Select the appropriate low tip warning message from the drop-down list. You can choose to display the default message, a custom message, or no message at all.

-

Select the override function for the system to take when an employee receives a message after declaring a tip amount outside of the defined declaration threshold. You can let the employee continue with their clock out, display another prompt for the employee to declare their tips again, or require manager approval for the employee to clock out.

Note: To allow an employee, typically a manager, to approve a clock out, select ‘Approve clock out’ in Maintenance > Labor > Pos Access Levels > Employee group bar for the access level to which the employee is assigned. If the employee declaring their tips is allowed to approve clock outs, the system assumes they are approving their own clock out and does not display the manager approval screen. The employee clocks out with the declared tips they entered.

-

Click Save.

-

Continue configuring each job code for tip declaration or exit the Jobcodes function.

Hourly amount plus charged tips

Use the ‘Hourly amount plus charged tips’ threshold type if you want your tip declaration based on the following calculation:

Low tip threshold amount’ x number of hours employee works + charged tips for the employee - tip refunds - tip share contribution

The system uses the current system date and time as the ending work time, since the employee has not actually clocked out.

SCENARIO: A server works 3.45 hours, receives $13.00 in charged tips, and pays $3.00 in tip share. The restaurant sets the ‘Low tip threshold amount’ to ‘5.’ When the server clocks out of the system, they must declare at least $27.25. [(3.45 hours x 5 = 17.25) + ($13.00 - $3.00 = $10.00) = $27.25].

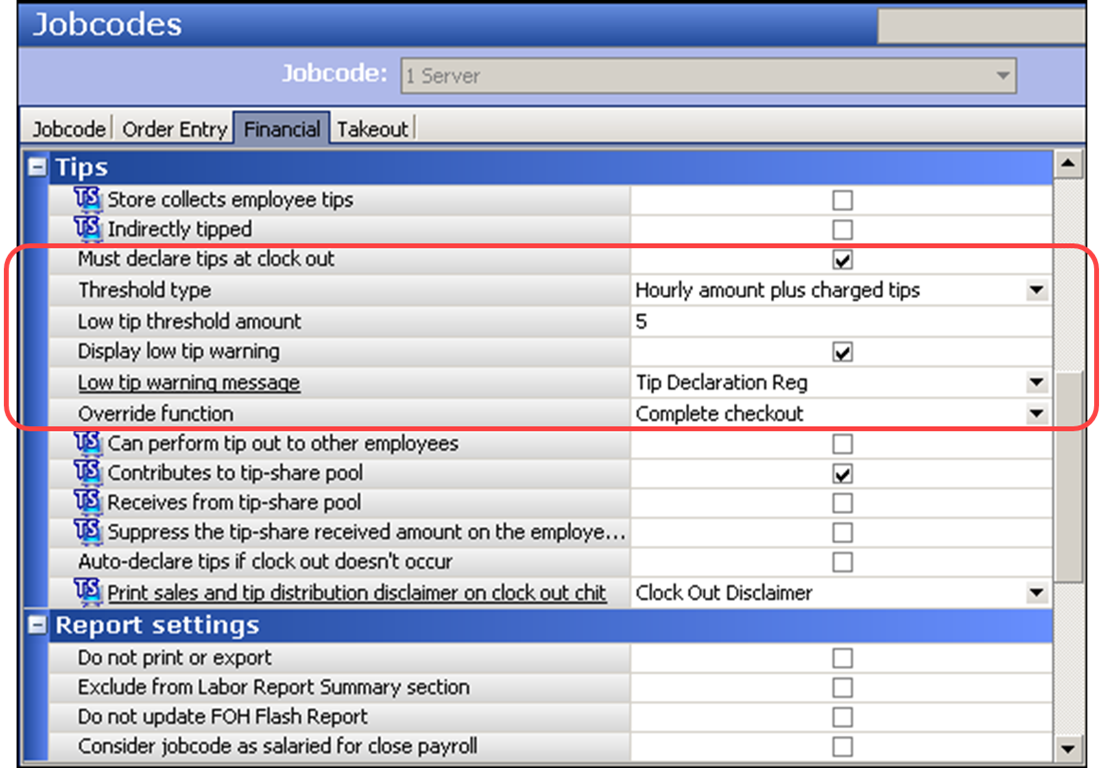

To configure a job code to use the ‘Hourly amount plus charged tips’ tip declaration threshold type:

-

Select the Maintenance > Labor > Jobcodes > Financial tab.

-

Select a job code from the ‘Number’ drop-down list and press Enter.

-

Under the ‘Tips’ group bar, select Must declare tips at clock out.

-

Select Hourly amount plus charged tips from the ‘Threshold type’ drop-down list.

-

Type the minimum amount, per hour worked, an employee must declare in the ‘Low tip threshold amount’ text box. For example, ‘5.’

-

Select Display low tip warning. If you clear this option, a message does not appear when an employee declares an amount outside the tip declaration threshold. You must select Shift required to clock in/out on the Jobcode tab and Must declare tips at clock out on the Financial tab to enable this option.

-

Select the appropriate low tip warning message from the drop-down list. You can choose to display the default message, a custom message, or no message at all.

-

Select the override function for the system to take when an employee receives a message after declaring a tip amount outside of the defined declaration threshold. You can let the employee continue with their clock out, display another prompt for the employee to declare their tips again, or require manager approval for the employee to clock out.

Note: To allow an employee, typically a manager, to approve a clock out, select ‘Approve clock out’ in Maintenance > Labor > Pos Access Levels > Employee group bar for the access level to which the employee is assigned. If the employee declaring their tips is allowed to approve clock outs, the system assumes they are approving their own clock out and does not display the manager approval screen. The employee clocks out with the declared tips they entered.

-

Click Save.

-

Continue configuring each job code for tip declaration or exit the Jobcodes function.

Percentage

Use the Percentage threshold type if you want your tip declaration threshold based on the following calculation:

The greater of: job code tip % threshold x employee’s tippable sales -OR- employee’s charged tips (when you clear ‘No Minimum declared tips’)

Note: This threshold type allows you to establish a different percentage for each job code. If all employees must declare the same percentage, use the ‘Global percentage’ threshold type.

SCENARIO: A server enters $100.00 in tippable sales. The restaurant sets the ‘Low tip threshold amount’ value for the server job code as ‘10.’ When the server clocks out of the system, they must declare at least $10.00. ($100.00 x 10% = $10.00).

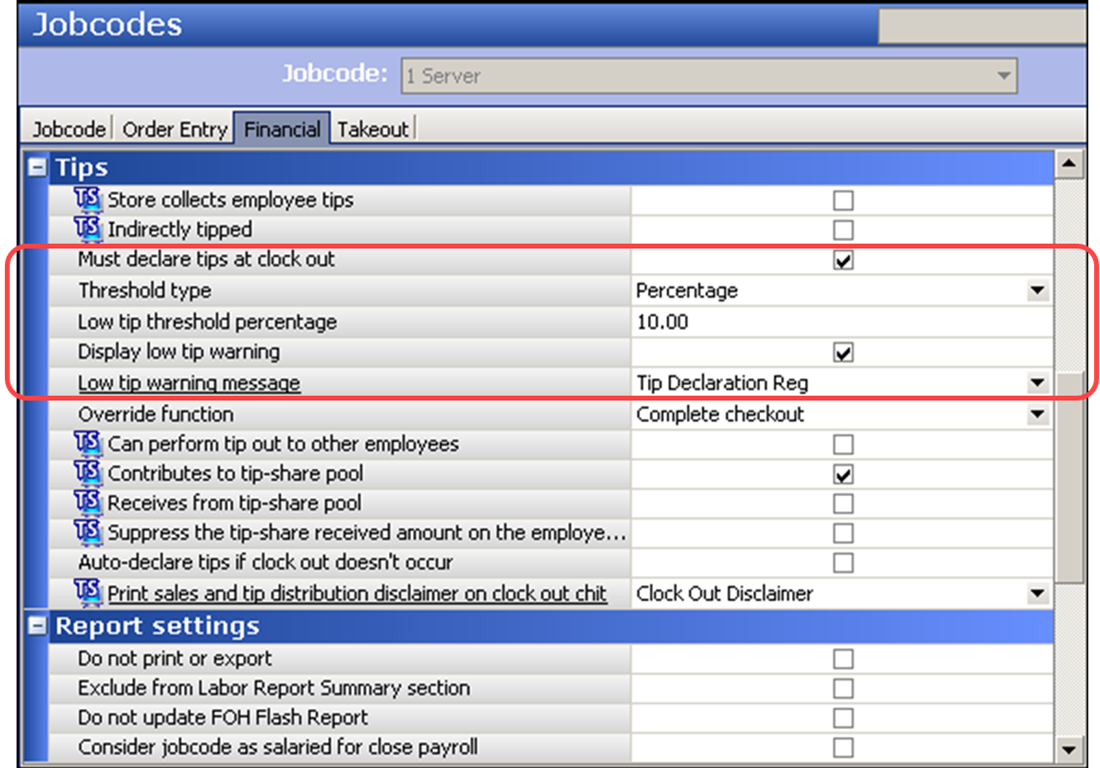

To configure a job code to use the ‘Percentage’ tip declaration threshold type:

-

Select Maintenance > Labor > Jobcodes > Financial tab.

-

Select a job code from the ‘Number’ drop-down list and press Enter.

-

Select Must declare tips at clock out.

-

Select Percentage from the ‘Threshold type’ drop-down list.

-

Type the percentage of their tippable sales an employee must declare in ‘Low tip threshold amount.’ For example, ‘10.’

-

Select Display low tip warning. If you clear this option, a message does not appear when an employee declares an amount outside the tip declaration threshold. You must select Shift required to clock in/out on the Jobcode tab and Must declare tips at clock out on the Financial tab to enable this option.

-

Select the appropriate low tip warning message from the drop-down list. You can choose to display the default message, a custom message, or no message at all.

-

Select the override function for the system to take when an employee receives a message after declaring a tip amount outside of the defined declaration threshold. You can let the employee continue with their clock out, display another prompt for the employee to declare their tips again, or require manager approval for the employee to clock out.

Note: To allow an employee, typically a manager, to approve a clock out, select ‘Approve clock out’ in Maintenance > Labor > Pos Access Levels > Employee group bar for the access level to which the employee is assigned. If the employee declaring their tips is allowed to approve clock outs, the system assumes they are approving their own clock out and does not display the manager approval screen. The employee clocks out with the declared tips they entered.

-

Click Save.

-

Continue configuring each job code for tip declaration or exit the Jobcodes function.

Percentage of cash sales

Use the ‘Percentage of cash sales’ threshold type if you want your tip declaration based on the following calculation:

‘Low tip threshold percentage’ for the job code x cash tippable sales only for the employee - tip share contribution from cash tippable sales only + (charged tips for the employee - tip refunds - tip share contribution from non-cash tippable sales only)1

1 System adds after employee declares

Note: Effective in Table Service v14.1, you can calculate the minimum tip declaration threshold based on total cash tippable sales, regardless if the employee contributes to a tip-share pool. You must select ‘Exclude cash tender type tips and gratuity from charged tips’ in Maintenance > Business > Store > Store Settings tab > Financials group > Tips group bar.

When you select ‘Percentage of cash sales,’ the system separates the transactions tendered to cash from the transactions tendered to non-cash, and the employee must declare against their cash tippable sales only. The system later adds the charged tips to the tip declaration.

SCENARIO WITHOUT TIP SHARE: A server enters $300.00 in tippable sales, $200.00 of which is tendered to cash and $100.00 is tendered to non-cash. The server also receives $30.00 in credit card tips. The restaurant sets the ‘Low tip threshold percentage’ to ‘10.’ The server must declare at least $10.00 (10% x $100.00) in cash tips. Afterward, the system adds their charge tips of $30.00 (10% x $200.00). If the server declares the minimum threshold only, their overall declared amount is $40.00 ($10.00 + $30.00).

The same logic applies when a restaurant is using tip share. Tip share is subtracted from the overall tips for the server; therefore, the server does not declare that amount. The system separates the tip-share amount calculated from transactions tendered to cash from transactions tendered to non-cash.

TABLE SERVICE SCENARIO WITH TIP SHARE: A server enters $300.00 in tippable sales, $200.00 of which is tendered to credit cards and $100.00 is tendered to cash. The server also receives $30.00 in credit card tips. The restaurant sets the ‘Low tip threshold percentage’ to ‘10.’ Based on total tippable sales, the system determines the server must contribute $9.00 to the tip-share pool. Since the server is declaring against cash sales only, the tip share contributed from cash sales must be taken out. The system calculates $3.00 for the tip share contributed from cash sales ($9.00 / $300.00 x $100.00). The server must declare at least $7.00 in cash tips (10% of $100.00 - $3.00). Afterwards, the system adds the calculated charge tips of $24.00 to the tip declaration, based on the tip share from non-cash sales [$30.00 - ($9.00 / $300.00 x $200.00)]. If the server declares the minimum threshold only, their overall declared amount is $31.00 ($7.00 + $24.00).

In the case where the server has no cash sales, or the tip share amount causes the cash tips for the server to equal a zero or negative amount, the server must declare $0.00. The system then adds the amount of charged tips.

Note: ‘Allow tip declaration less than charged tips’ applies to charged tips only and has no impact on the ‘Percentage of cash sales’ tip declaration threshold type.

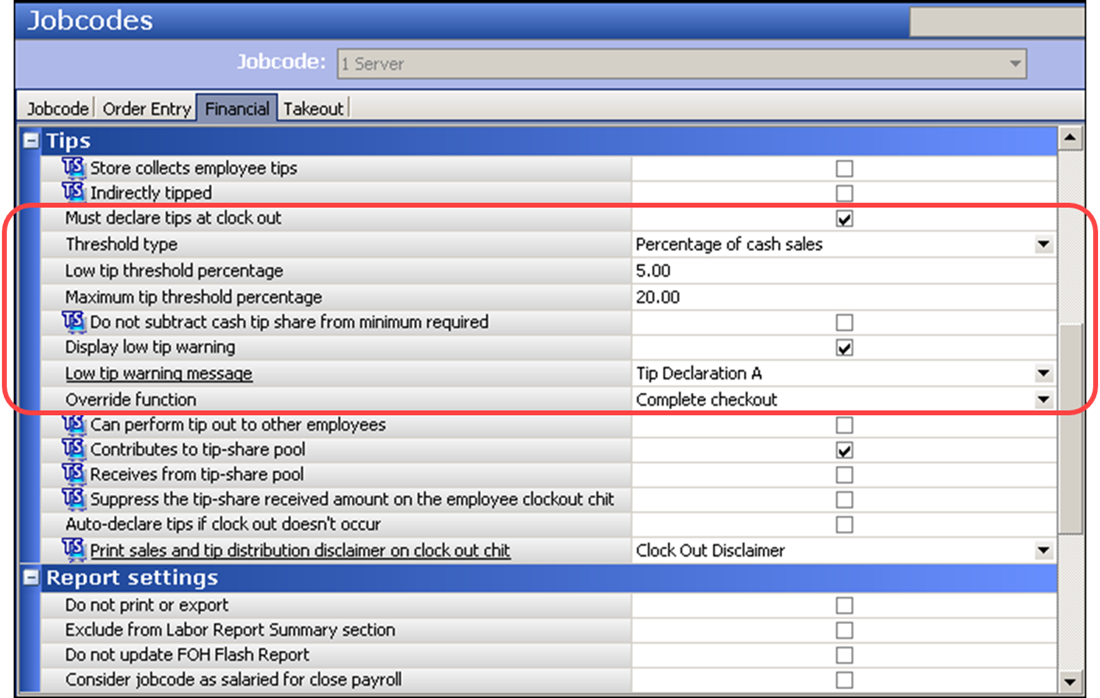

To configure a job code to use the ‘Percentage of cash sales’ tip declaration threshold type:

-

Select Maintenance > Labor > Jobcodes > Financial tab.

-

Select a job code from the ‘Number’ drop-down list and press Enter.

-

Under the ‘Tips’ group bar, select Must declare tips at clock out.

-

Select Percentage of cash sales from the ‘Threshold type’ drop-down list.

-

Type the minimum percentage of cash sales an employee must declare in ‘Low tip threshold percentage.’ For example, ‘5.00.’

-

Type the maximum percentage of cash sales an employee can declare in ‘Maximum tip threshold percentage.’ For example, ‘20.00.’

Note: A value of 0 (zero) indicates no maximum. The ‘Percentage of cash sales’ option is the only tip declaration that supports a maximum amount an employee can declare.

-

Select Do not subtract cash tip share from minimum required if you want the system to calculate the minimum declaration threshold based on total cash tippable sales, regardless if the employee contributed to a tip-share pool. This option is available for Table Service only, and, by default, the system subtracts the tip share amount contributed by the employee based on their cash sales when calculating the minimum declaration threshold.

Do not subtract cash tip share from minimum required — Calculates the minimum tip declaration threshold based on total cash tippable sales, regardless if the employee contributed to a tip-share pool. When cleared, the system subtracts the tip share contributed by the employee for cash sales when calculating the minimum tip declaration threshold. Documented Version: v14.1.

-

Select Display low tip warning. If you clear this option, a message does not appear when an employee declares an amount outside the tip declaration threshold. You must select ‘Shift required to clock in/out’ on the Jobcode tab and ‘Must declare tips at clock out’ on the Financial tab to enable this option.

-

Select the appropriate low tip warning message from the drop-down list. You can choose to display the default message, a custom message, or no message at all.

-

Select the override function for the system to take when an employee receives a message after declaring a tip amount outside of the defined declaration threshold. You can let the employee continue with their clock out, display another prompt for the employee to declare their tips again, or require manager approval for the employee to clock out.

Note: To allow an employee, typically a manager, to approve a clock out, select ‘Approve clock out’ in Maintenance > Labor > Pos Access Levels > Employee group bar for the access level to which the employee is assigned. If the employee declaring their tips is allowed to approve clock outs, the system assumes they are approving their own clock out and does not display the manager approval screen. The employee clocks out with the declared tips they entered.

-

Click Save.

-

Continue configuring each job code for tip declaration or exit the Jobcodes function.

The Charge Tips amount that appears on the Enter Declared Cash Tips screen reflects all tips and gratuities, including those collected for cash tender types. You can configure the system to track tips and gratuity for cash tender types separately from non-cash tips and gratuity when using the ‘Percentage of cash sales’ threshold type. The Charge Tips that appear on the Enter Declared Cash Tips screen no longer include cash tips and gratuities.

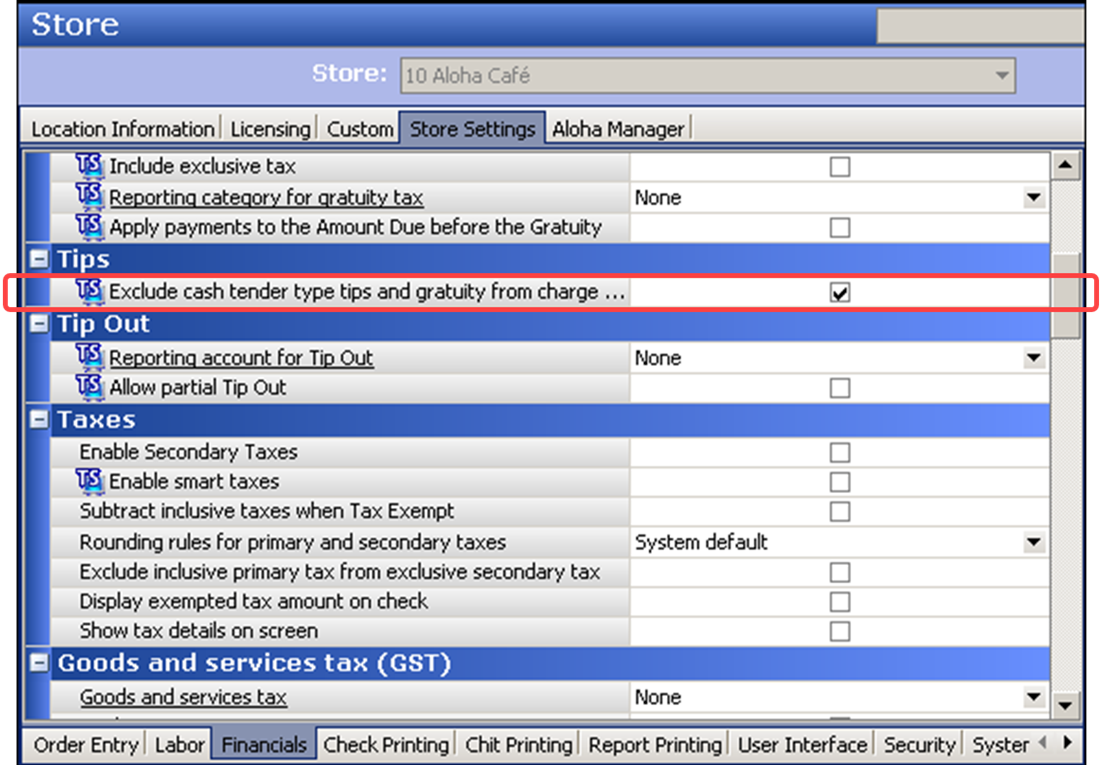

To ensure the Charge Tips amount on the Enter Declared Cash Tips screen reflects only non-cash tips and gratuities:

- Select Maintenance > Business > Store > Store Settings tab.

- Select the Financials group located at the bottom of the screen.

- Under the ‘Tips’ group bar, select Exclude cash tender type tips and gratuity from charge tips to track tips and gratuity for cash tender types separately from credit cards tips when using the ‘Percentage of cash sales’ threshold type for tip declaration. The Charge Tips that appear on the Enter Declared Cash Tips screen reflect tips and gratuity from non-cash tenders only.

- Click Save and exit the Store function.

Continue to "Refreshing POS data."

After running a data refresh, return to the main Tip Declaration page.