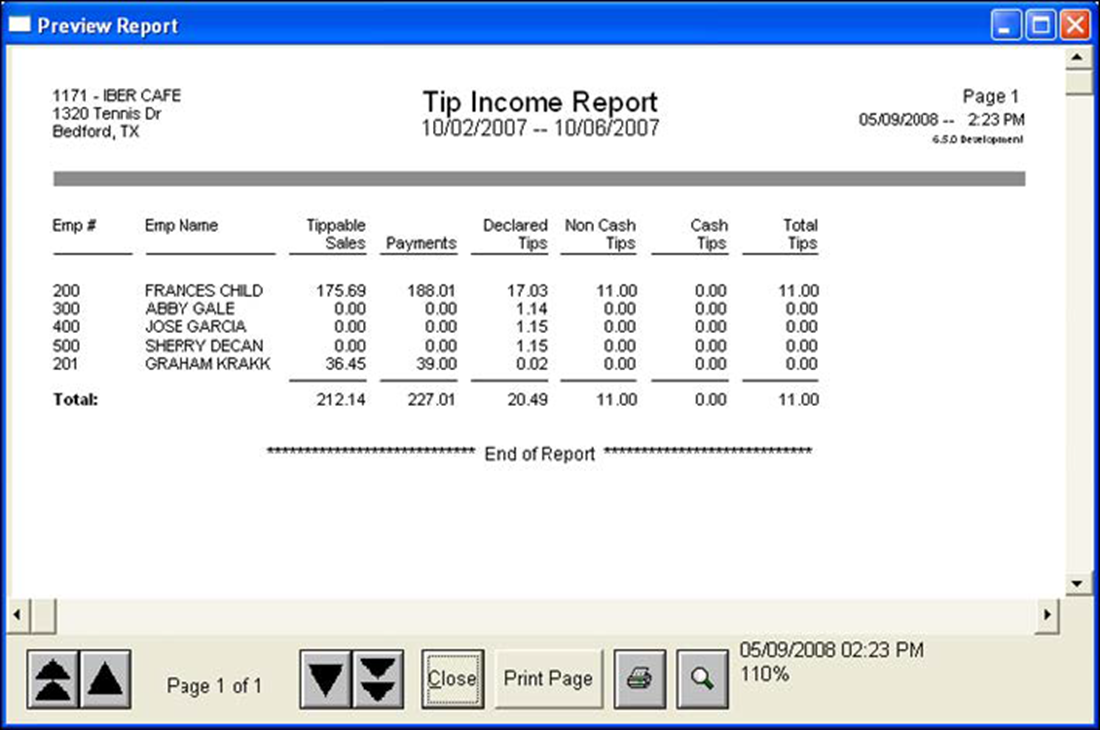

Viewing the Tip Income Report

The Tip Income Report is used to conform to the IRS TRAC reporting policy. The report includes tippable sales, declared tips, charged sales with tips, charged tips, and auto gratuities for each employee. The Charge Tips column includes tips and auto gratuity for all charge sales. The Auto Grat column is for cash auto gratuities only. This report allows a summary over a specified range of dates to be created.

Return to the main "Tip Declaration" page.