Creating flex tax rules

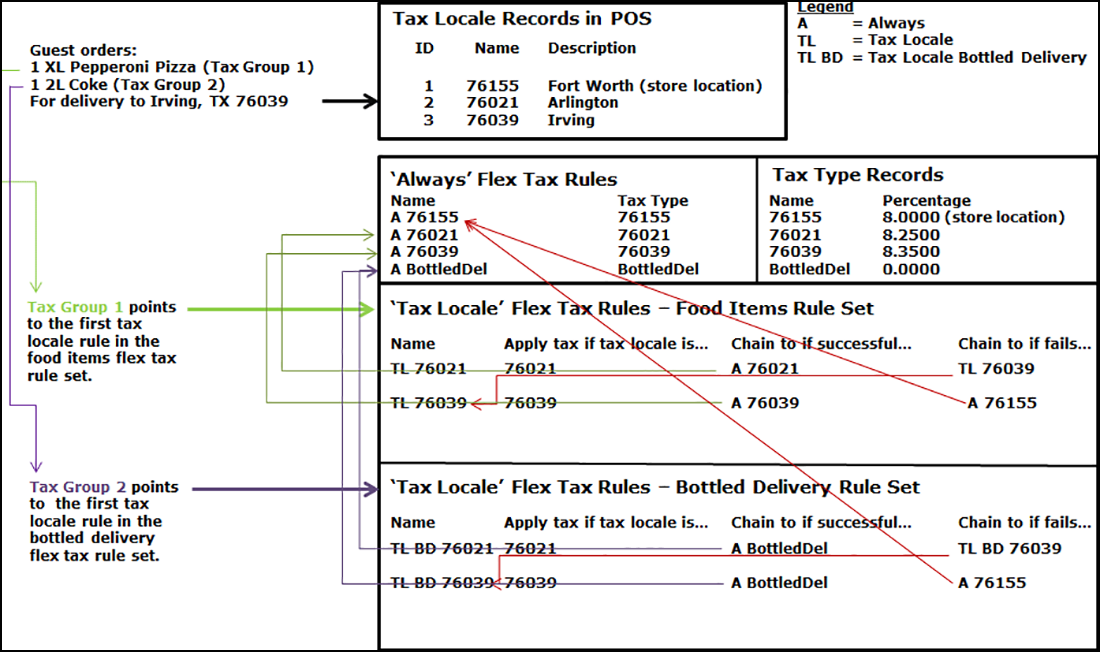

Create as many flex tax rules as needed to support your store location and each delivery area that is subject to tax by destination. The system requires you to create two methods of flex tax rules to support the Tax by Destination feature: 'Always' and 'Tax locale.'

Note: If you are an existing ATO installation, an 'Always' flex tax rule for your store location may already exist and you do not need to create another one. However, you still need to create all other flex tax rules required to support the Tax by Destination feature.

It is necessary to:

-

Create an 'Always' flex tax rule for: The store location

-AND-

Each tax locale that is subject to tax by destination,

-AND-

Each additional tax rule you need to support, such as delivered bottled beverages.

Associate the 'Always' flex tax rule with the corresponding tax type you created for it in the Tax Type function. For example, when creating an 'Always' flex tax rule for your store location, associate that rule with the tax type you created for your store location (ZIP code 76155 in the scenario).

-

Create a 'Tax locale' flex tax rule set for:

Each tax locale to which you are subject to tax by destination,

-AND-

Each additional tax rule you need to support.

You establish a link from one 'Tax locale' flex tax rule to another until you reach the end of the chain, which you then link back to the 'Always' flex tax rule for the store location. For each 'Tax locale' flex tax rule, it is necessary to make selections for:

Apply tax if tax locale is - Select a tax locale for a ZIP code subject to tax by destination.

Chain to if successful - Select the 'Always' flex tax rule that corresponds to the tax locale or additional tax rule for which you are currently creating a 'Tax locale' flex tax rule.

Chain to if fails - Select the next 'Tax locale' flex tax rule in the chain. The exception is when you create the last 'Tax locale' flex tax rule in the chain, which must link back to the 'Always' flex tax rule for the store location.

Later in this configuration, you will specify for which order modes you want to enable tax by destination. For example, you want to enable tax by destination for the order mode you use for delivery orders, but not for the order mode you use when the guest picks up their order at your store. When you apply an order mode for which you enable tax by destination, ATO reads the ZIP code in the delivery address, compares it to the postal codes in ATO to determine the tax locale in the POS. The system does the following:

-

Reads the first item in the order and uses the tax group assignment to determine the first 'Tax locale' flex tax rule in the chain.

-

If the tax locale matches the selection in 'Apply tax if tax locale is,' the system processes the 'Chain to if successful' link, which chains to an 'Always' flex tax rule associated with a tax type. It then drops out of the chain and calculates taxes using the rate associated with the tax type.

If the tax locale does not match the selection in 'Apply tax if tax locale is,' the system processes the 'Chain to if fails' link. The 'Chain to if fails' link chains to the next 'Tax locale' flex tax rule in the chain.'

-

The system repeats step 2 until it either meets a successful condition or gets to the last 'Tax locale' flex tax rule in the chain, whichever comes first. If the tax locale fails to meet the successful condition for the last 'Tax locale' flex tax rule, the fail condition in this rule links back to the 'Always' flex tax rule for the store location and the system calculates the taxes accordingly.