Creating tax types

Create a tax type for each jurisdiction for which you must support tax regulations. Enter the tax percentage as a total of all state and local sales taxes.

Referring back to the scenario, it is necessary to create a tax type for ZIP code 76155, which is the store location, one tax type each for the ZIP codes to which you deliver, 76021 and 76039, and a tax type for delivered bottled beverages, which are subject to a tax rate of '0.00.'

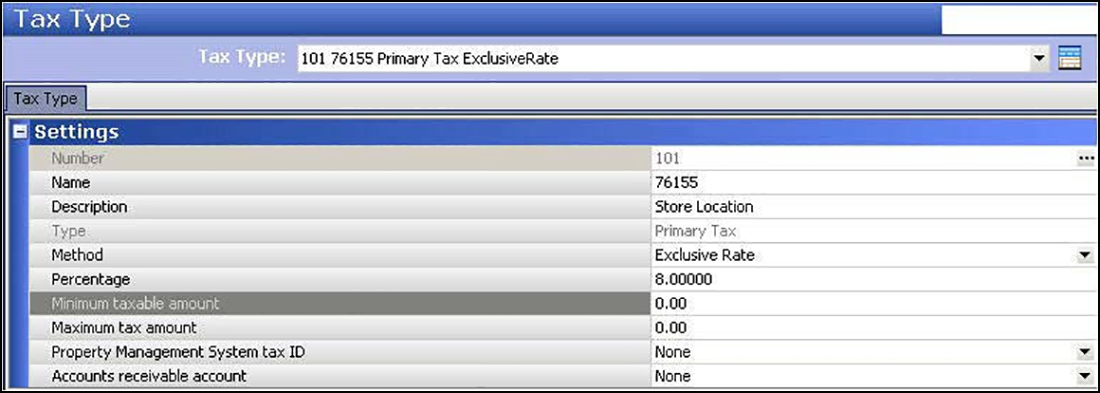

To create a tax type to support your store location:

Note: If you are an existing ATO installation, a tax type for your store location already exists and you do not need to create another one. Skip this procedure and move to the next one to create tax types for each jurisdiction for which you must support tax regulations.

- With QS or TS selected in the product panel, select Maintenance > Taxes > Tax Type.

- Click the New drop-down arrow, select Primary as the tax type, and click OK.

- Accept the system assigned number or click the ellipsis (...) button to choose your own number.

- Name the tax type using the ZIP code for your store location, for ease in identification.

- Type a description to help identify this tax type as one for your store location, such as 'Store Location.'

- Select Exclusive Rate from the 'Method' drop-down list.

- Enter the percentage as a total of all state and local sales taxes.

- Click Save.

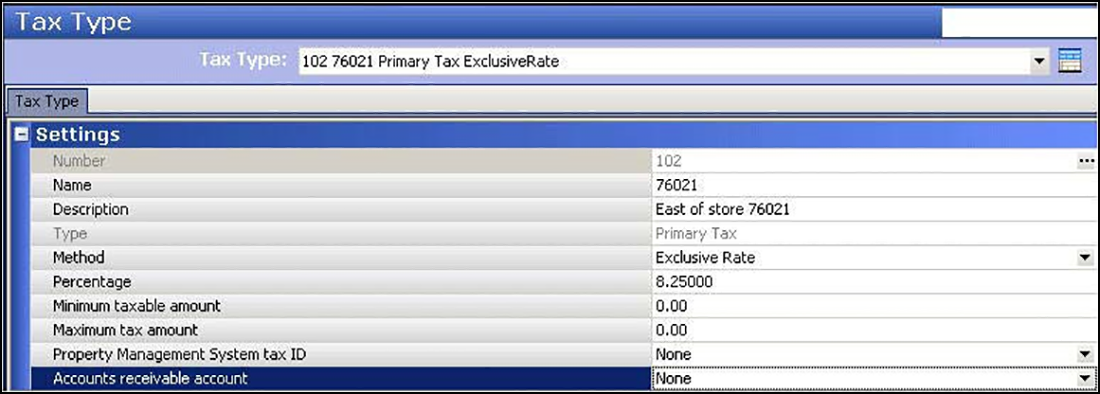

To create a tax type for each delivery area subject to tax by destination:

- While still in the Tax Type function, click the New drop-down arrow, select Primary as the tax type, and click OK.

- Accept the system assigned number or click the ellipsis (...) button to choose your own number.

- Name the tax type using the ZIP code for the corresponding delivery area, for ease in identification.

- Type a description to help identify this tax type as one for this tax locale, such as a geographical location followed by the ZIP code or a major street followed by the ZIP code.

- Select Exclusive Rate from the 'Method' drop-down list.

- Enter the percentage as a total of all state and local sales taxes.

- Click Save.

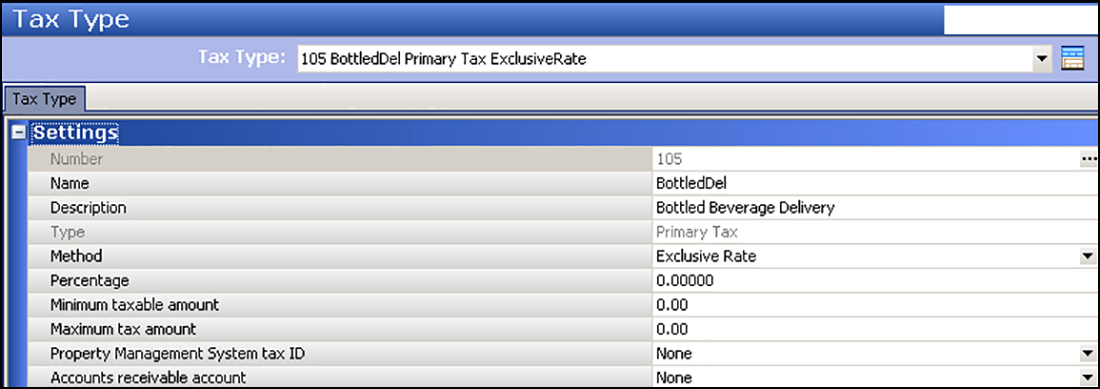

To create as many tax types as needed to support additional tax rules, such as zero tax on delivered bottled beverages:

- While still in the Tax Type function, click the New drop-down arrow, select Primary as the tax type, and click OK.

- Accept the system assigned number or click the ellipsis (...) button to choose your own number.

- Name the tax type using a name for ease in identification, such as 'BottledDel' for delivered bottled beverages.

- Type a description to help identify this tax type as one for this additional tax rule, such as 'Bottled Beverage Delivery.'

- Select Exclusive Rate from the 'Method' drop-down list.

- Enter the percentage as a total of all state and local sales taxes.

- Click Save and exit the Tax Type function.