Using Tax by Destination

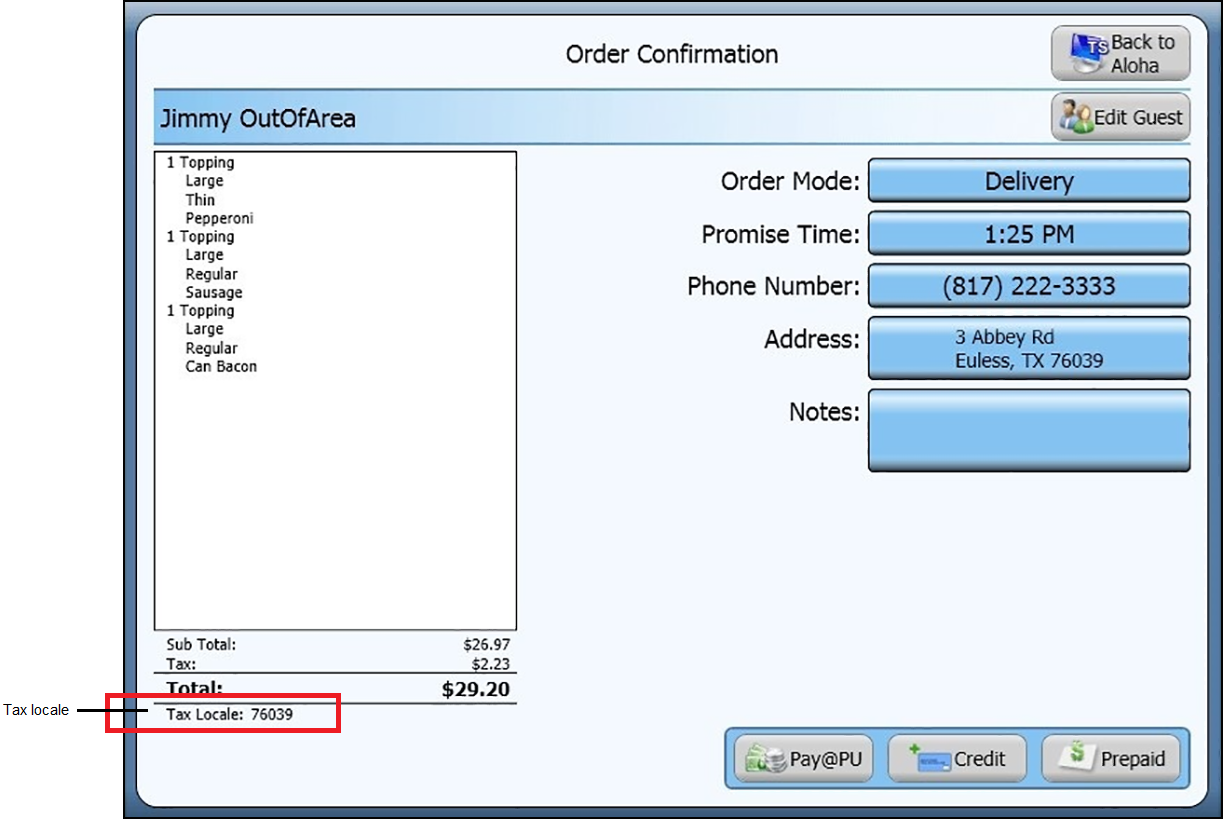

Aloha Takeout applies tax by destination when you apply a check to an order mode for which you enable tax by destination and the delivery area is one for which you are subject to tax by destination. If a tax locale applies to the order, the system displays 'Tax Locale: ZIP code' to the check detail on the Order Confirmation screen. The system also displays the same message on the bottom left side of the Check Details screen. No additional steps are required in the ordering process, unless you want to override the tax locale the system applied to the order.

Overriding Tax by Destination

Aloha Takeout uses ZIP codes to determine the tax rate to assess. In some instances, a ZIP code may include two separate tax jurisdictions. Aloha Takeout enables you to override the tax locale associated with the zip code and assess the tax rate of a different tax locale, which would normally be the tax locale for your operation.

-

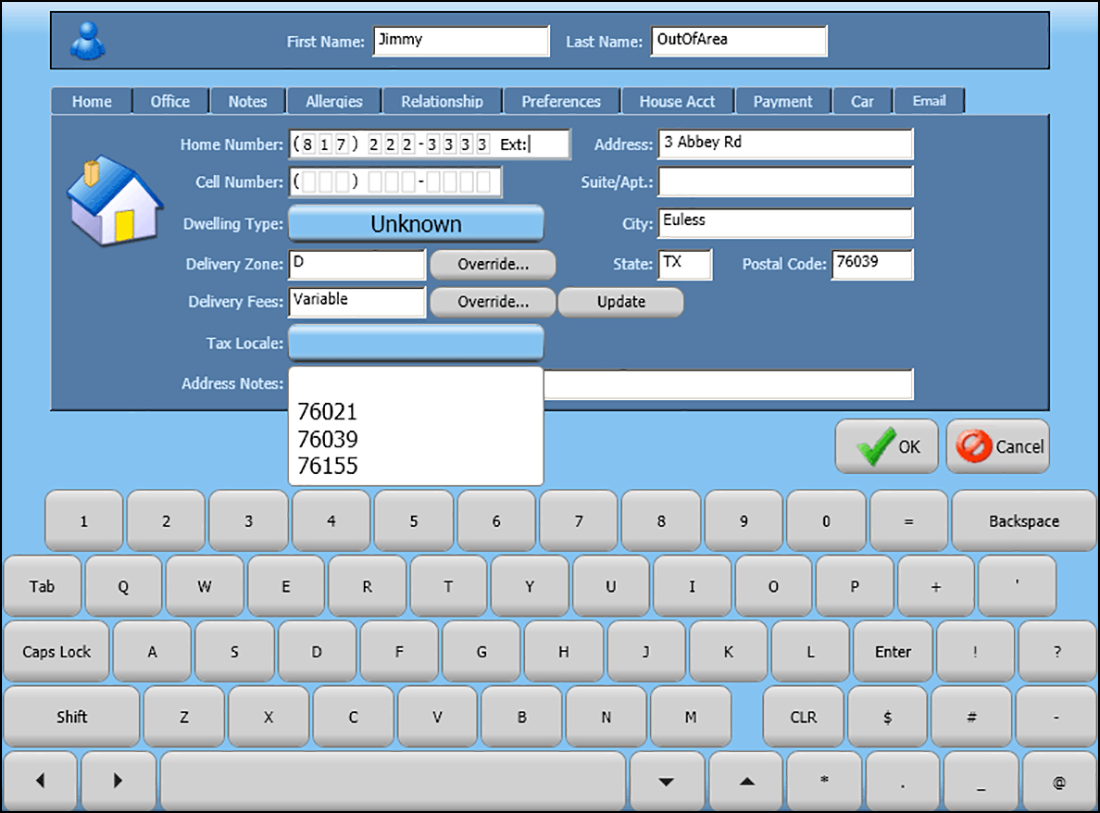

At the Order Confirmation screen, touch Edit Guest on the top right side of the screen. The Customer Details screen appears.

-

At the Home tab, select a tax locale from the drop-down list.

-

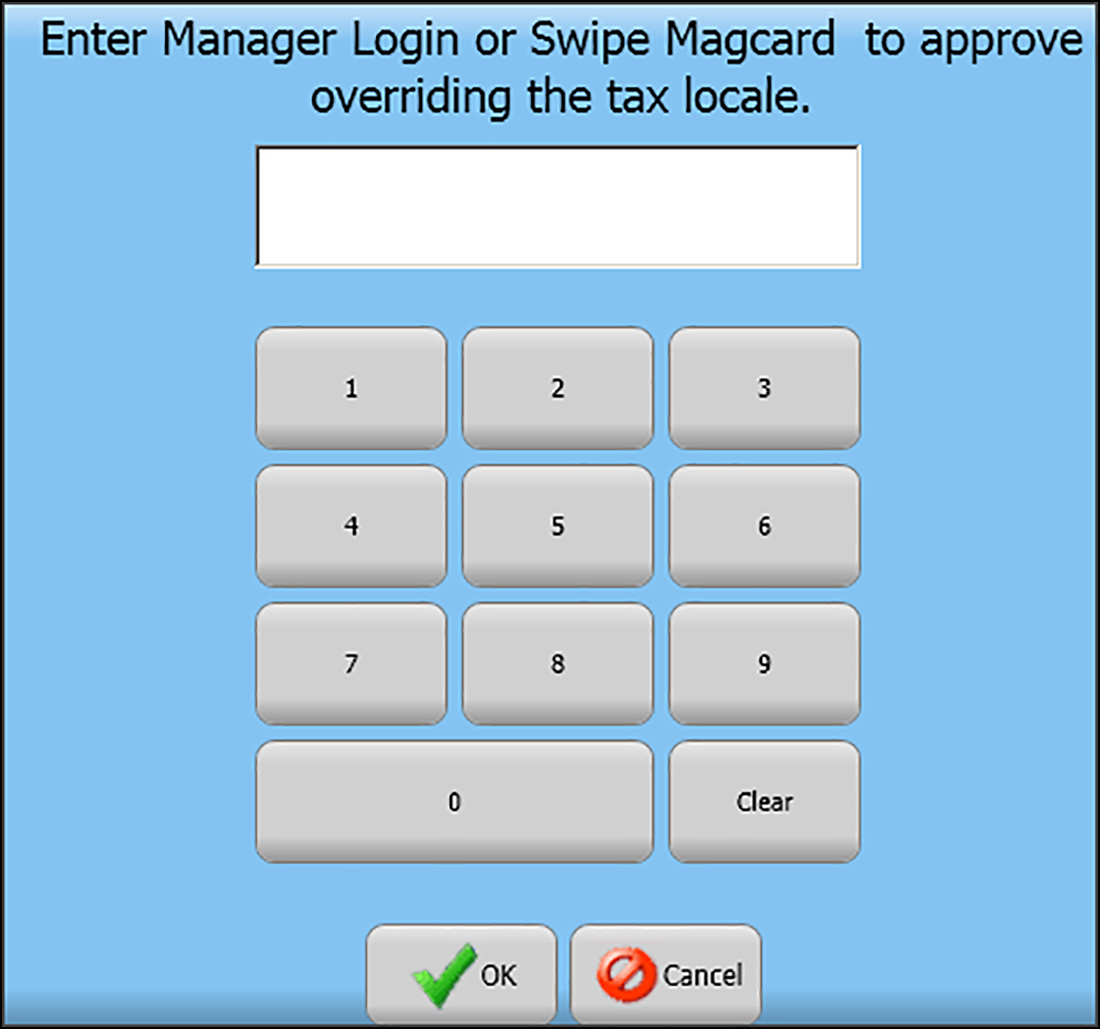

Obtain authorization, if necessary. An employee with the ability to override tax locale must authorize this transaction.

If you cannot approve a tax locale override, request manager assistance. A manager or employee with sufficient access must enter their login credentials to allow the tax locale.

-

At the Customer Details screen, touch OK. The Order Confirmation screen appears and the updated tax locale appears in the bottom left portion of the screen.

-

Proceed with the order as normal.