Creating a custom tip declaration threshold message

You can use messages to inform an employee when they declare an amount outside of the calculated declaration threshold. You can configure the system to display the default message, a custom message, or no message at all, based on the job code under which an employee logs in to the system. If you select Default, the default message, Your declared tips are less than the defined threshold, appears. The default message, Your declared tips are greater than the defined threshold, also appears for the ‘Percentage of cash sales’ threshold type when an employee enters an amount higher than the maximum.

To create a custom tip declaration threshold message:

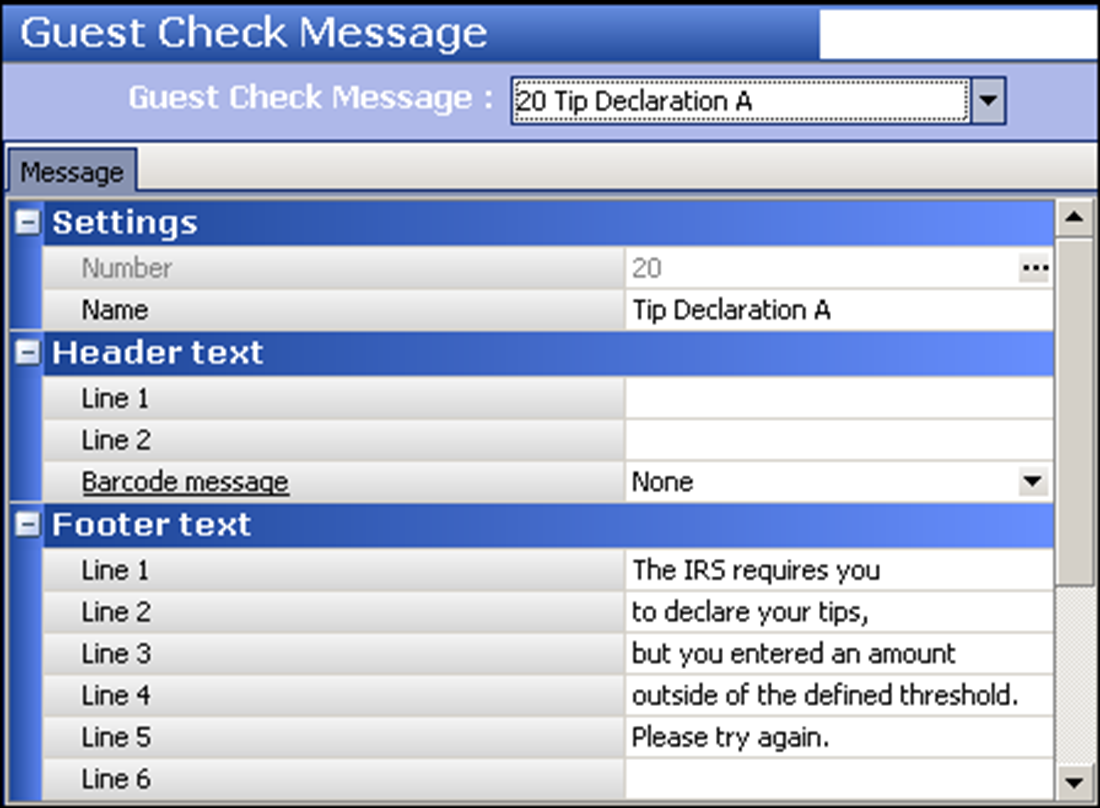

- Select Maintenance > Messaging > Guest Check Message. The appearance of this tab is the same for Quick Service and Table Service.

- Click New.

- Accept the system-assigned number or click the ellipsis (...) next to ‘Number’ to display the Number Assignment dialog box, from which you can choose an alternate number.

- Type a message that is descriptive of its purpose. If you are using the ‘Percentage of cash sales’ tip declaration threshold type, type a custom message to appear that encompasses when an employee declares too little or too much, such as the following: “The IRS requires you to declare your tips but you entered an amount outside of the defined threshold. Please try again,’ as seen in the Guest Check Message screen above. For all other tip declaration threshold types, type a custom message to appear when an employee declares too little, such as the following: “The IRS requires you to declare your tips but you entered an amount less than the defined declaration threshold. Please try again.”

- Click Save.

- Repeat this procedure, as needed.

- Click Save and exit the Guest Check Message function.

Continue to "Choosing the tip declaration threshold type."