Loyalty Balance report

The Loyalty Balance report allows you to view and track balances and liabilities related to your loyalty program. This report will only appear if your brand utilizes points or punches for your loyalty program. You’ll be able to select a date cut-off as well as an Earning Type if your brand uses more than one.

Note: Be sure you have an Account Group selected or applied to your user to view all of the reports.

Report views

Your report view will change depending on your view choice. You’ll be able to select from Location, Program, Card Set, and Holds.

Location view

The Location view breaks the report table out by owning location.

Program view

The Program view breaks the report table out by program.

Card Set view

The Card Set view breaks the report table out by card set.

Holds view

The Holds view returns all balances with a held status.

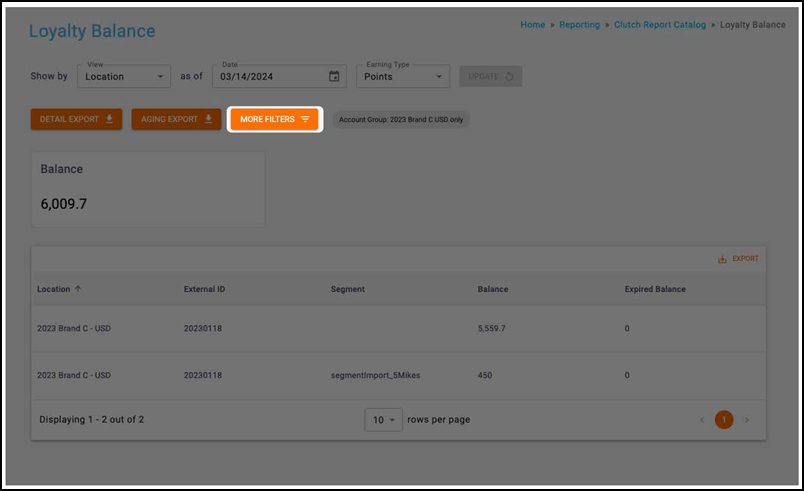

Filters

You can target specific data within your report by selecting from MORE FILTERS. These filters include:

Date Range — All dates are specific to the brand’s reporting time zone that is configured in their brand settings.

- Start dates begin as of 12:00:00AM of the chosen date.

- End dates end as of 11:59:59PM of the chosen date.

Location — Allows you to filter transactions by location.

Program — Filter transactrions by program.

Info box

The info box showing the balance appears with the Location, Program, and Card Set views.

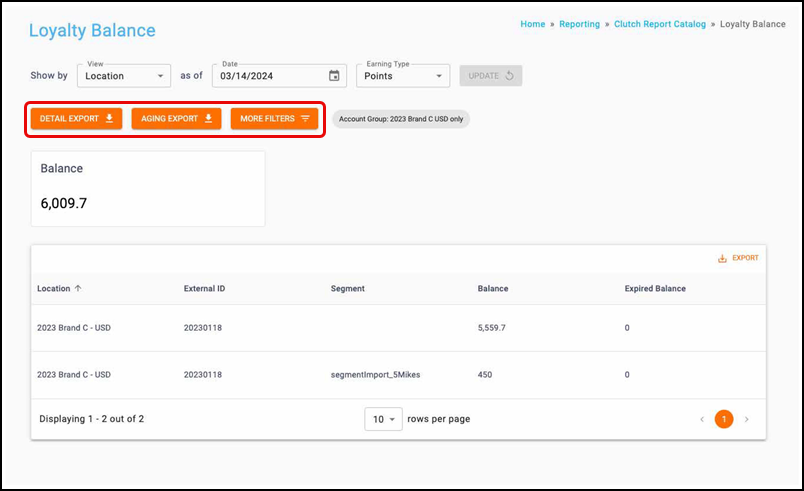

Table

Available columns vary based on the view that is selected. Table columns include:

- Location (Location and Holds views only)

- External ID (Location and Card Set views only)

- Program (Program view only)

- Program Type (Program view only)

- Card Set (Card Set view only)

- Segment (All views except Holds view)

- Balance (All views except Holds view)

- Expired Balance (All views except Holds view)

- Earning Type (Holds view only)

- Held Balance (Holds view only)

Note: The Segment column only populates if your brand has used Segment Import to tag and split out a balance for a segment of cards.

To view any definitions for these metrics, consult this article.

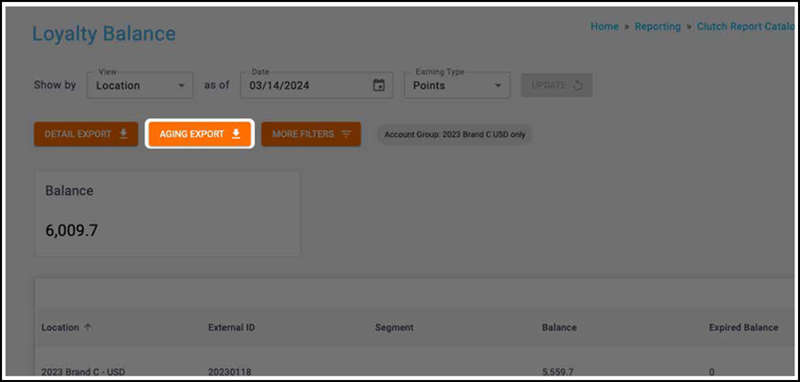

Aging export

The Aging export provides an Excel file with a burndown of all balances that match the filter criteria. You can export an Excel file by clicking the AGING EXPORT button. The file is broken out vertically by issuing month and horizontally by each activity month since the issuing month. The export is not available in report Views that show multiple balance types (Ex: Reward Type, Currency, or Holds) because it can only be run for one balance type at a time.

| Headers | Description |

|---|---|

| Initial Credit Month | The month in which the cards were issued. |

| Cards | The total count of cards issued in the given month. |

| Initial Credit Amount | Total value issued to the cards in the given month. |

| Description | The row descriptions. |

| Date | The month in which the value is being measured. |

| Rows | Description |

|---|---|

| Issuance Amount | Of the issued cards in the initial credit month, this row shows the amount issued to those cards. |

| Redemption Amount | Of the issued cards in the initial credit month, the amount that was redeemed from those cards. |

| Remaining Amount | Of the issued cards in the initial credit month, this represents the amount remaining at the end of the column month. |

| % of Remaining Liability | Remaining Amount / (Initial Credit Amount + Issuance Amounts). |

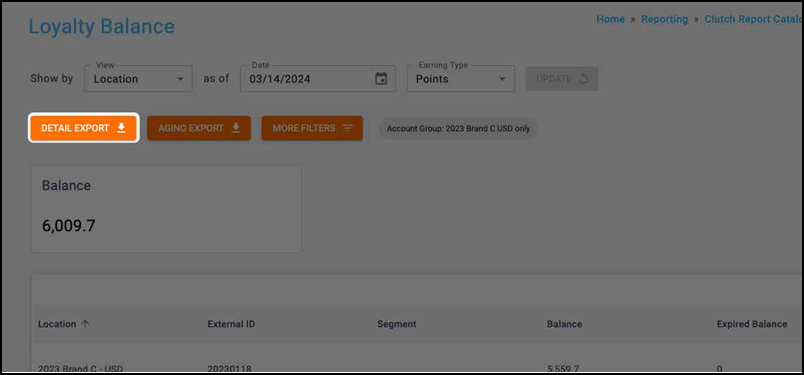

Detail export

The Detail export provides card-level detail of all cards that have balances matching the filter criteria. Note that this export is not available in report views that show multiple balance types as it can only be run for one balance type at a time. You are able to export either an Excel or CSV file by clicking the DETAIL EXPORT button. All files over one million records are automatically converted to CSV. When your export is finished processing, it will be available to download in the Notification Center or Report Center.