Employee payroll report

Use the 'Employee payroll' report to view employee payroll information for a selected pay period. The summary section of the report displays the hours and dollars by job, and any overtime or penalty pay earned by the employee. The detail section of the report displays information for individual punches. This report provides you with the option to generate a summary and detailed data related to employee payroll.

The 'Employee payroll' report provides two different views:

Summary — Displays the total for the pay period by employee and job.

Detail — Displays the total for the pay period by employee and job by individual shifts.

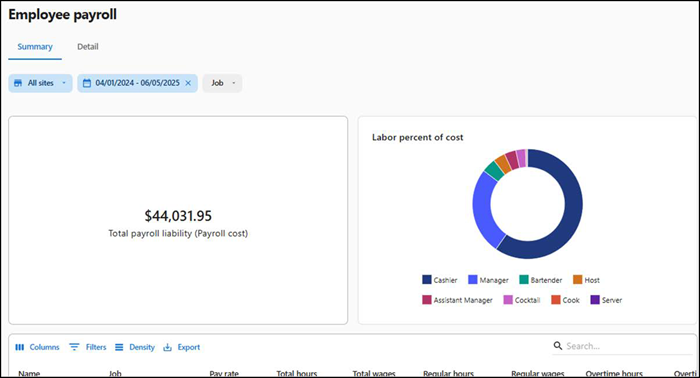

Viewing the 'Employee payroll' report - Summary view

The 'Employee payroll' Summary report displays the total payroll liability cost and labor percent of cost.

To run the 'Employee payroll' report - Summary view:

- Select Labor > Reports > Employee payroll. The details in the Summary tab appear by default.

- Select the site(s) from the drop-down.

- Select the date range from the list given on the left side of the drop-down.

- Select the job(s) from the drop-down provided.

The following details appear in the tiles:

Total payroll liability (Payroll cost) — Total cost incurred as salary to the restaurant, or to all of the employees for the selected period.

Labor percent of cost — Breakup of cost incurred by job. Hover-over the graph to view the labor cost (in percentage) and salary (in currency).

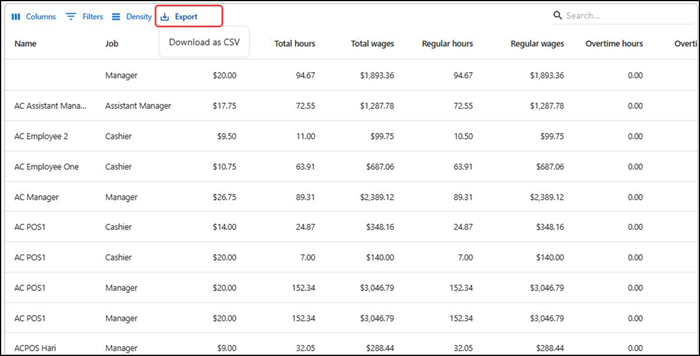

The 'Employee payroll' Summary report displays the payroll liability cost and labor percent of cost, by employee.

The following information appears in the report:

| Column | Description |

|---|---|

| Name | The name of the employee. |

| Employee POS ID | The unique ID of the employee on POS. |

| Job | The job under which the employee worked. |

| Pay rate | The pay rate for the job under which the employee worked. |

| Total hours | The total number of hours the employee worked. |

| Total wages | Total amount paid to the employee. |

| Regular hours | The total number of regular hours worked. |

| Regular wages | The salary of the employee. |

| Overtime hours | The hours the employee worked as overtime. |

| Overtime wages | The amount paid to the employee for working overtime. |

| Premium hours | The hours the employee worked overtime. |

| Premium wages | The amount paid to the employee for working overtime. |

| Total net sales | The amount of sales belonging to that particular employee. |

| Declared tips | The total amount of tips declared. |

| Total tips | Total tips paid through the POS. |

| Tip percent | The percentage of tips amount. |

Note: The Export option in the 'Employee payroll' report appears when the report is loaded with data. You can download the report in CSV format, and the file appears in the Downloads folder of your browser. The report generates based on the filters and search terms you apply. Both summary and detail views have the export option.

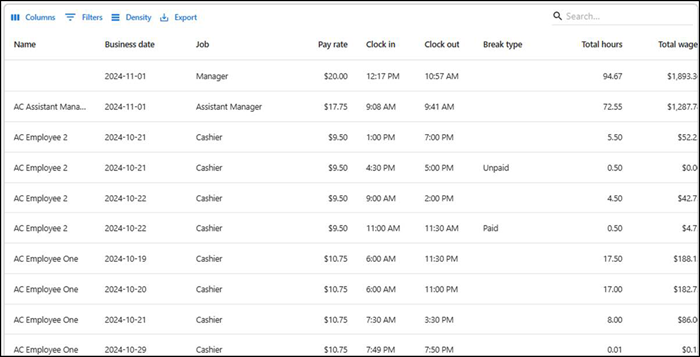

Viewing the 'Employee payroll' report - Detail view

The 'Employee payroll' report's detailed view displays the total for the pay period by employee and job by individual shifts.

To run the 'Employee payroll' report - Detail view:

- With the 'Employee payroll' report open, select the Detail tab.

- Select the site(s) from the drop-down.

- Select the date range from the list given on the left side of the drop-down.

- Select the job(s) from the drop-down provided.

The following details appear in the tiles:

Total payroll liability (Payroll cost) — Total cost incurred as salary to the employee for the selected period.

Labor percent of cost — Breakup of cost incurred by job. Hover-over the graph to view the labor cost (in percentage) and salary (in currency).

The following information appears in the report:

| Column | Description |

|---|---|

| Name | Name of the employee. |

| Business date | The date of transaction. |

| Job | The job under which the employee worked. |

| Pay rate | The pay rate for the job under which the employee worked. |

| Clock in | Employee clock in time. |

| Clock out | Employee clock out time. |

| Break type | Specifies the type of break the employee had. |

| Total hours | The total number of hours the employee worked. |

| Total wages | Total amount paid to the employee. |

| Regular hours | The total number of regular hours worked. |

| Regular wages | The salary of the employee. |

| Overtime hours | The hours the employee worked as overtime. |

| Overtime wages | The amount paid to the employee for working overtime. |

| Premium hours | The hours the employee worked overtime. |

| Premium wages | The amount paid to the employee for working overtime. |

| Total net sales | The amount of sales belonging to that particular employee. |

| Declared tips | The total amount of tips declared. |

| Total tips | The total amount of tips. |

| Tip percent | The percentage of tips amount. |

Return to "Working with labor reports."