Taxes

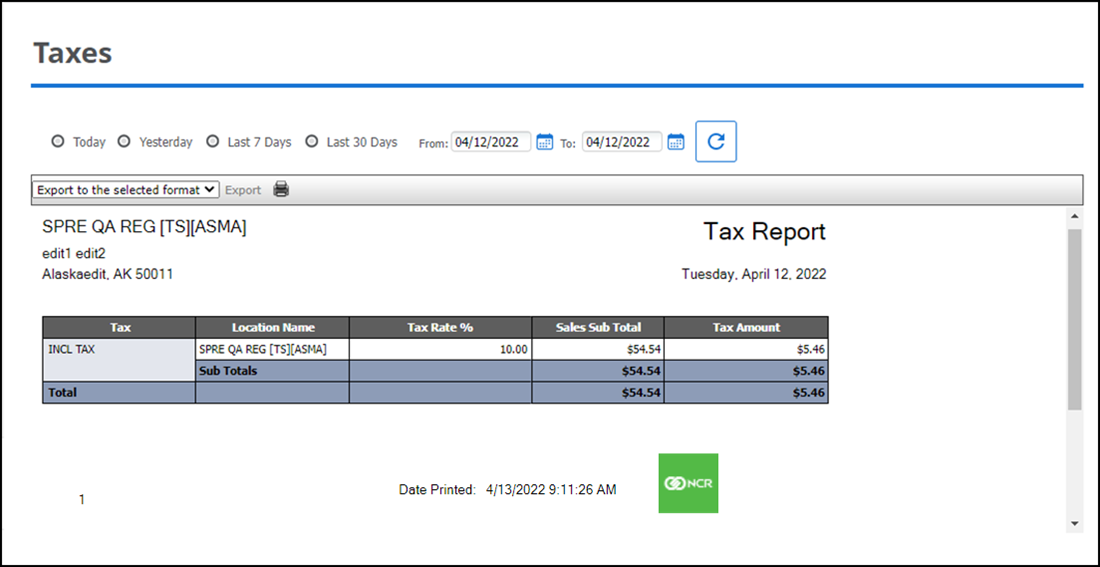

The Taxes report provides you with a breakdown of the taxes collected by tax jurisdiction for a selected time period. If you sell at multiple locations, this report breaks down the tax information for each of your selling locations.

To run the Taxes report:

- Select Results > Operations Reports > Taxes.

- To refine your search, select a date or date range.

- Click the refresh icon to refresh the report data.

The report showing the information with the following fields:

| # | Column | Description |

|---|---|---|

| 1 | Header | Header includes: - The name and address of the store. - The selected time period for the report. - The name of the report. |

| 2 | Tax | The name of the tax category. |

| 3 | Location Name | The name of the location. |

| 4 | Tax Rate % | The tax rate percentage for the tax category. |

| 5 | Sales Sub Total | The total amount of sales for the tax category prior to assessing the sales tax. |

| 6 | Tax Amount | The total amount of the amount of sales tax collected for the tax category. |

| 7 | Total | The totals for each column. |