Exempting a tax in the POS

You may need to exempt the tax applied to the guest check for certain individuals, such as police and military personnel in uniform that visit the restaurant, eligible organizations, such as churches and charitable organizations, and any other consumer or group that qualifies for tax exemption.

Note: For more information on configuring taxes, refer to Working with taxes

-

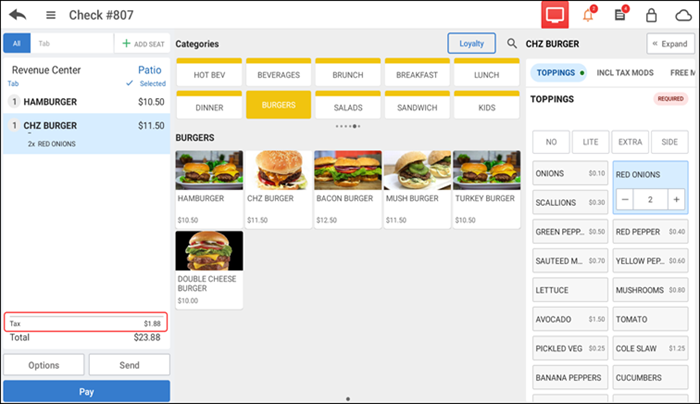

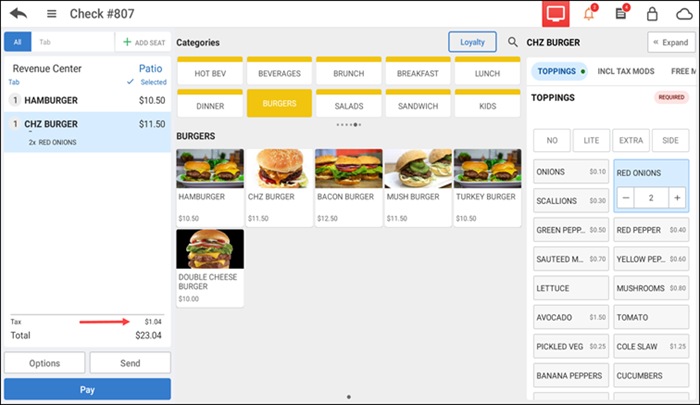

Ensure the guest check is active on the order entry screen.

-

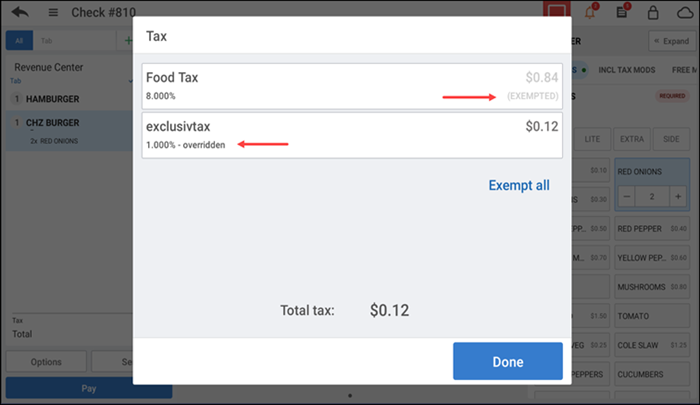

Tap the tax appearing at the bottom of the order ticket window to view the Tax screen.

-

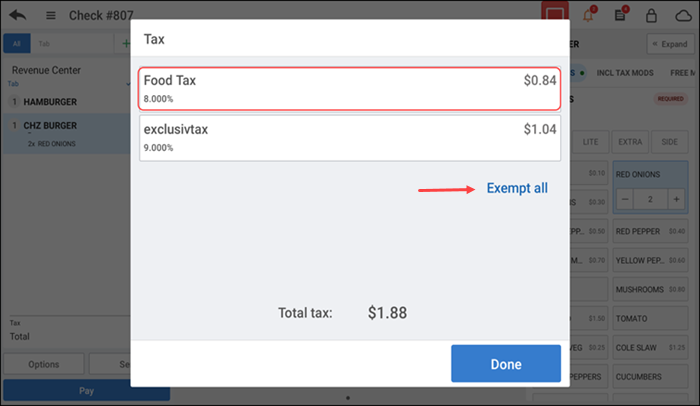

Tap the tax to exempt.

-

Tap Exempt all and tap Done to remove all taxes applied to the guest check and return to the order entry screen and close the check, as normal.

-OR-

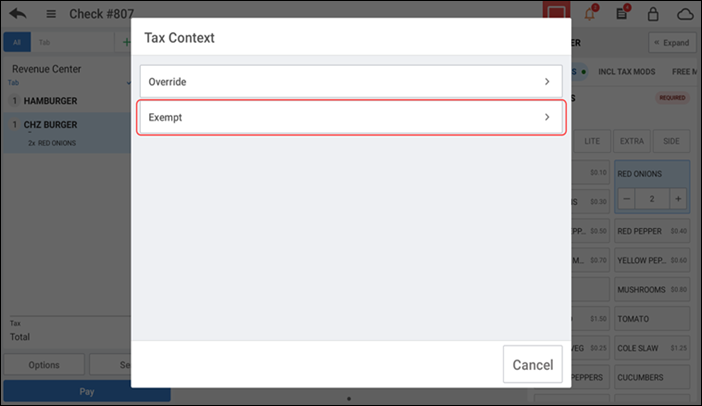

Tap the specific tax to exempt. The Tax Content screen appears.

-

Tap Exempt to remove the tax entirely. The tax amount changes to zero.

-OR-

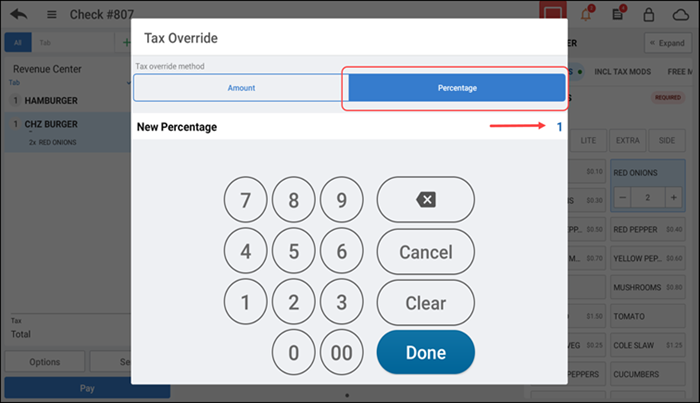

Tap Override. The Tax Override screen appears with the Amount tab active by default.

-

Accept the new amount of '$0.00' or type a new tax amount.

-OR-

Tap Percentage, accept the new percentage of '0' and tap Done, or type a new tax percentage and tap Done. The updated amount appears on the screen.

-

Tap Done to apply the changes and return to the order entry screen. The new tax amount appears in the order ticket window.

-

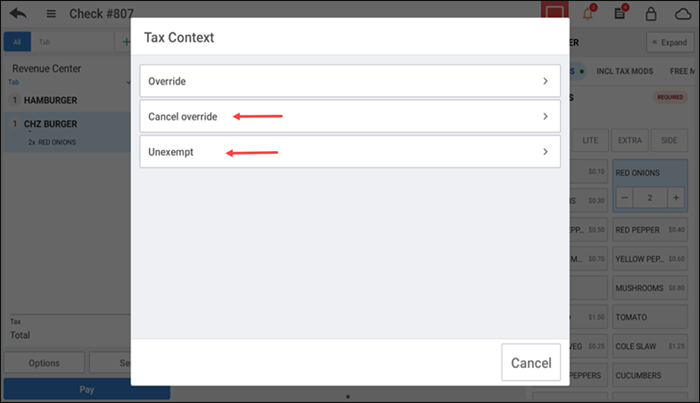

To revert the changes, tap the tax in the order ticket window and tap Cancel override' or Unexempt.