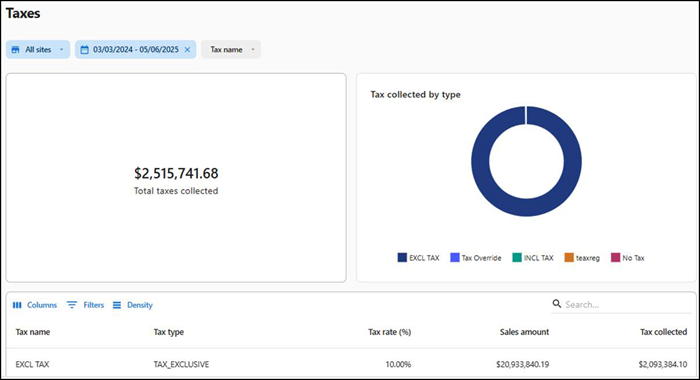

Taxes

The 'Taxes' report displays the amount of tax collected on each transaction and displays the amount levied as tax and deducted from the gross amount.

To run the 'Taxes' report:

- Select Sales > Report > Taxes. The Taxes report for the previous day appears by default.

- Select a site from the All sites drop-down list to report. You can toggle the list to Select all Sites.

- Click Reset to reset the site selection.

- Select a date range from the drop-down list.

- Select the Tax name from the drop-down list.

The report dynamically updates with each selected parameter. Reporting data appears on the following tiles:

Total taxes collected — Displays the total amount of tax collected.

Tax collected by type — Displays the total amount of tax collected based on the tax type. The data appears in a circle with different colors differentiating the type of tax. Hover over areas of the circle to view the percent of the total taxes and the amount of taxes collected.

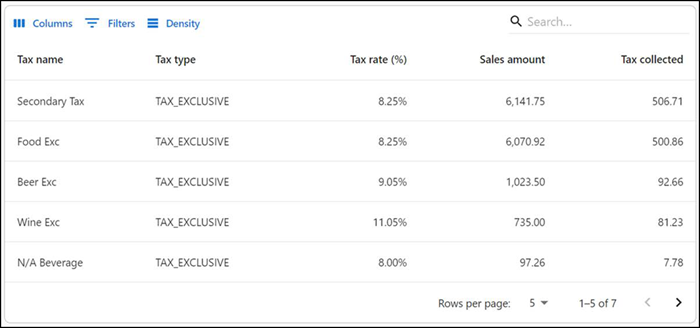

The data appears in the form of a table with the following information:

| Column | Description |

|---|---|

| Tax name | Name of the tax category |

| Tax type | Type of tax applied |

| Tax rate(%) | Percentage of the amount to be deducted |

| Sales amount | Amount to be collected as tax for the tax category |

| Tax collected | Total amount collected as tax |

Return to "About sales reporting."