Revenu Quebec Fiscal Requirements

Core Product: Aloha Quick Service, Aloha Table Service

Complimentary Products: No

Separate License Required? No

Other References: Aloha Quick Service Manager Guide, Aloha Quick Service Reference Guide

View/Download/Print: Revenu Québec Fiscal Requirements Feature Focus Guide - HKS378

About Revenu Québec Fiscal Requirements

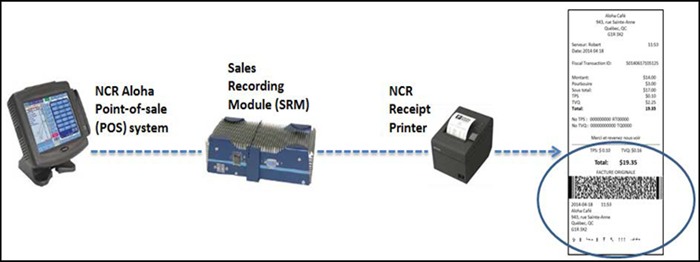

The Québec government has certain fiscal requirements in place to help ensure everyone pays the correct income tax, and that consumption taxes paid by consumers, such as in a restaurant establishment, are properly remitted to the government. If your restaurant establishment is registered for the Québec sales tax (QST), the law requires that your Aloha® Point-of-Sale (POS) terminal pass the sales data through a sales recording module (SRM) to provide SRM-generated receipts to your customers. When a transaction occurs, the SRM device intercepts the transaction and adds a fiscal transaction ID and bar code to the bottom of the receipt. Once you activate an SRM device, you must use it at all times to produce your receipts and you must submit a monthly periodic sales summary to the Québec government.

Reference: Refer to "https://www.revenuquebec.ca/en/a-propos/evasion_fiscale/restauration/secteur.aspx" for more detailed information on supporting fiscal requirements for Revenu Québec.

Configuring Revenu Québec Fiscal Requirements

Configuring the fiscal requirements for Revenu Québec is a multi-step process. This section details the configuration requirements within Aloha Manager and Aloha Configuration Center (CFC) for Revenu Québec.

- Designating the fiscal printing agency

- Configuring printers to communicate with SRM

- Creating duplicate check button

- Configuring package deal

- Refreshing POS data.

Using Revenu Quebec Fiscal Requirements

Learn how to use Revenu Quebec Fiscal Requirements

Revision History

View the development history of Revenu Quebec Fiscal Requirements.